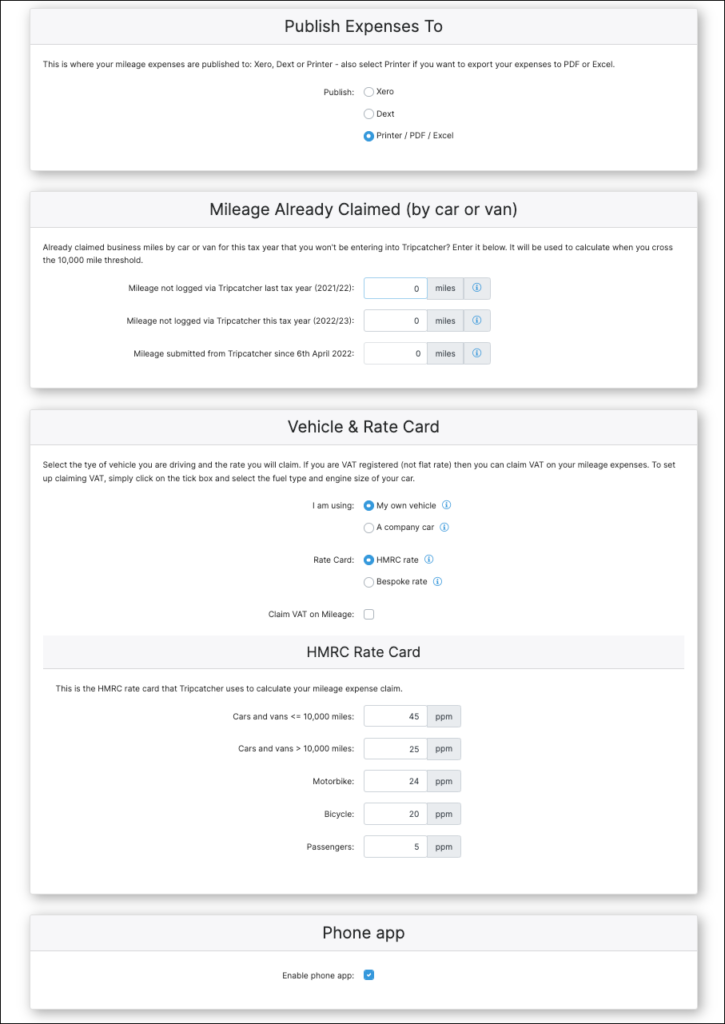

Now you’ve activated your Tripcatcher account the next step is to configure your account settings. This is to ensure your mileage expenses are calculated correctly.

The Settings page is where this action happens. When you first login your Tripcatcher account will have the default settings eg HMRC recommended mileage rates. These default settings can be changed to suit your needs.

NB These instructions are not suitable for Crunch users as your setup is slightly different. Please see these instructions.

Tripcatcher Settings Page

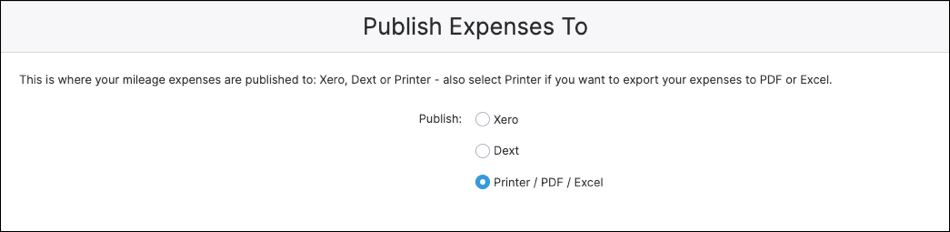

Publish Expense To

This section is for setting where you want to publish your mileage. This can be to Xero, Dext (Receipt Bank) or Printer (this includes Excel and PDF). When you select to publish to Dext or Xero a new section will appear to enable you to connect Tripcatcher to your accounting/bookkeeping software.

NB If you have been invited to use Tripcatcher by your Accountant/Bookkeeper/Employer this will already be selected for you.

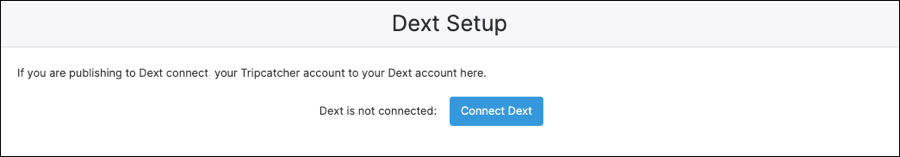

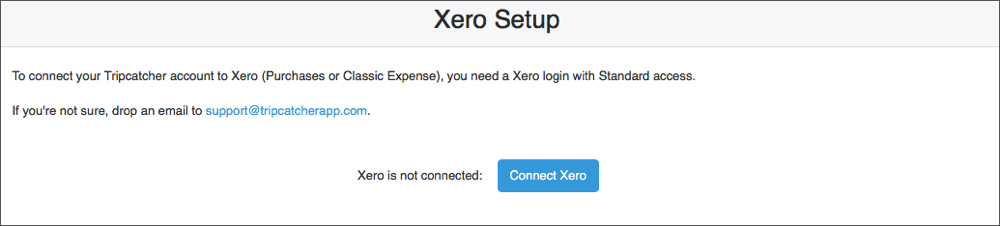

Dext or Xero Setup

Dext

When publishing your mileage to Dext you need to make a one time connection; click on the “Connect Dext” button and login to your Dext account. There are instructions here with more information.

Xero

When publishing your mileage to Xero your Tripcatcher account needs connecting to Xero. For Individual account users simply click on the “Connect Xero” button and follow the instructions.

For Partners and Admin users, you can connect yourself and your users. Please follow the Xero integration instructions for Partners.

NB If you have been invited to use Tripcatcher by your Accountant/Bookkeeper/Employer this should already be set up for you. If the connection is not set up please get in contact with the person that invited you to Tripcatcher and ask to be connected.

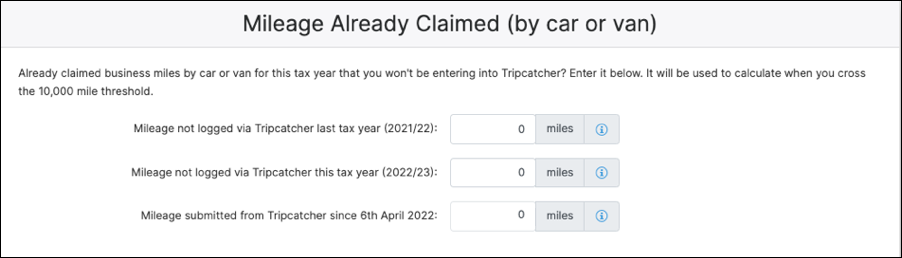

Mileage Already Claimed

This section is to ensure Tripcatcher calculates when your cross the HMRC 10,000 mileage threshold correctly.

If, in this personal tax year, you have already claimed for mileage outside of Tripcatcher eg using another system, you need to enter the number of miles you have already claimed for.

These extra miles will be added to the miles you claim through Tripcatcher. And if/when the miles added together are over 10,000 the mileage rate will be changed. If using HMRC recommended rates, the rate will be changed from 45ppm to 25ppm.

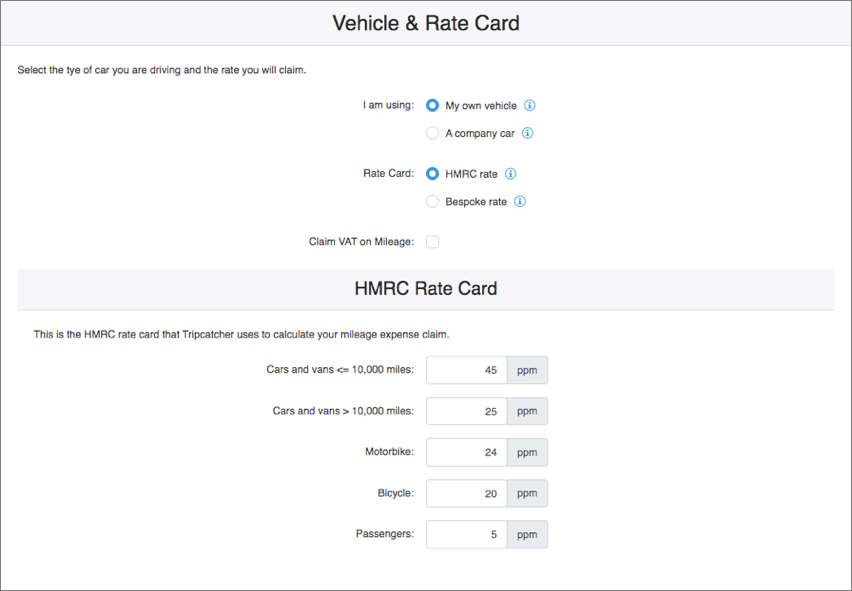

Vehicle and Rate Card

The default settings assume that you are driving your own car and claiming the HMRC recommended rates. If this is not the case then these settings can be changed. We have a guide that describes, step by step, how you change these settings.

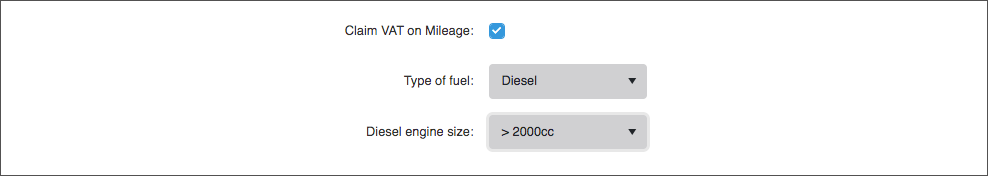

Claiming VAT on Mileage

If you are VAT registered (not flat rate), then you claim the VAT on your mileage expenses. To set this up click the “Claim VAT on mileage” box, in the Vehicle and Rate Card section. This will then allow you to select the type of fuel your car uses (eg Petrol, Diesel or LPD) and the engine size of your car. This information enables Tripcatcher to use the correct HMRC Advisory Fuel Rates for your business journeys.

Once claiming VAT is setup, Tripcatcher will automatically calculate the VAT you can claim on your mileage expenses and the fuel receipts you need to keep for the VAT man.

If you are interested in finding our more we have a great blog on claiming VAT on mileage.

Phone app

This section is for authorising Tripcatcher on your phone. This is a security feature. If you lose your phone you can turn off access to Tripcatcher on your lost phone, by un-selecting the tick box.

Once you get a new phone or retrieve your old phone then you can turn this feature back on.