Tripcatcher Partner Benefits

The Partner Account

The Tripcatcher Partner account is a multi-user account perfect for small businesses, accountants and bookkeepers.

Tripcatcher Partner helps you manage your clients/employees business mileage; the Partner account is made up of a Partner dashboard and Tripcatcher Individual accounts for your users.

The pricing is very simple, its £1.49 +VAT per user per month, with a minimum of 2 users.

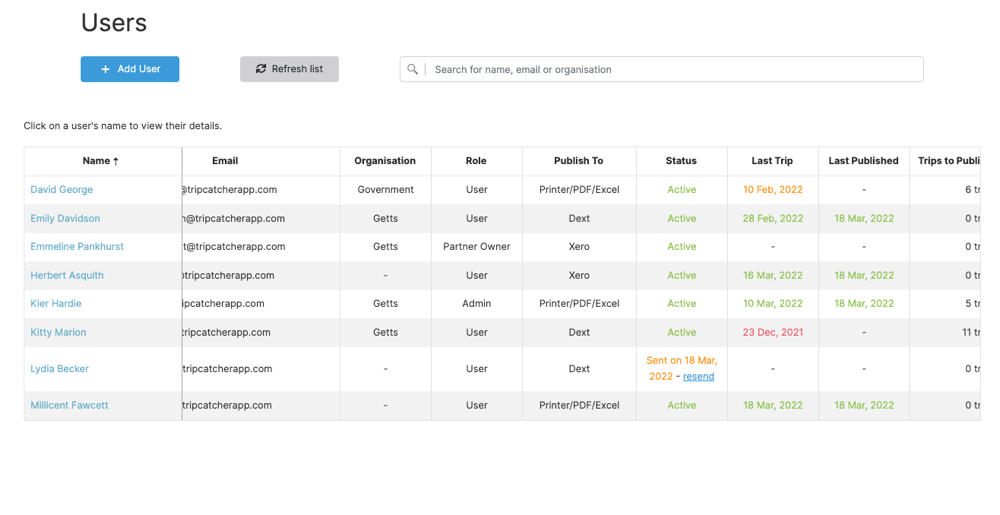

Users Dashboard

From the Users dashboard it’s really easy to invite your users; these may be clients, employees or admin users. And each user is provided with the full functionality of the Tripcatcher Individual account.

From the dashboard all admin users can see at a single glance, who is on top of their mileage. Tripcatcher uses the traffic light colour system; green coloured accounts are up-to-date with their mileage, amber accounts could do better and red accounts need investigating.

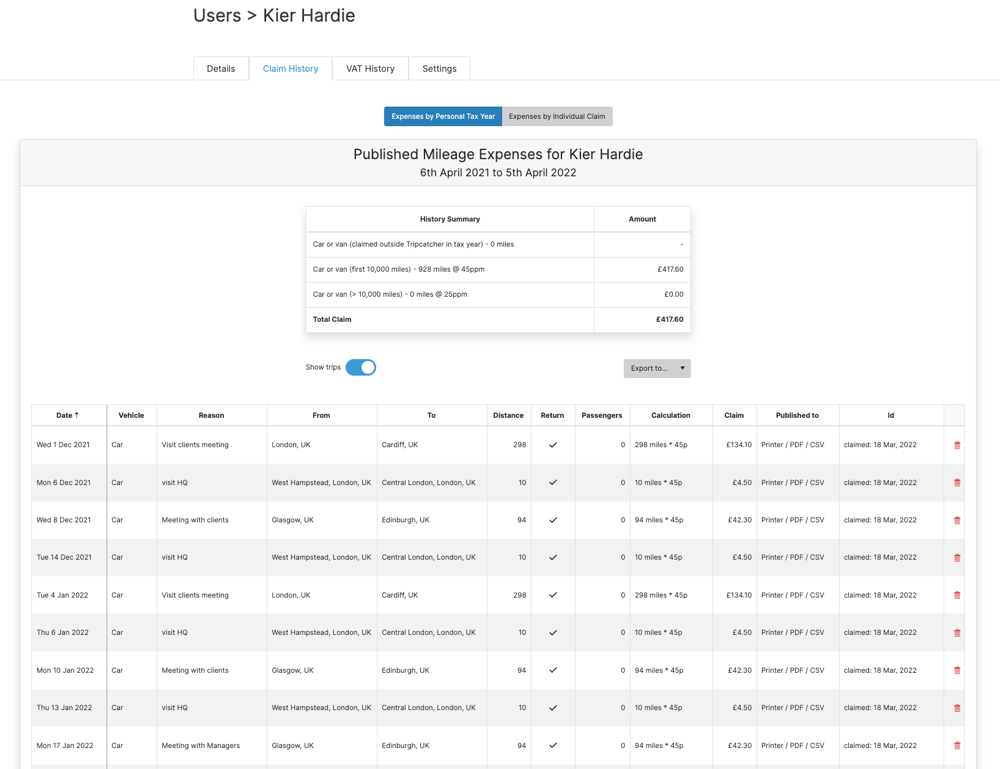

Drill Down – Mileage

The dashboard enables you to easily drill down into the details of the mileage published by your users. This mileage can be published to Dext, Xero, PDF or Excel and is shown on the user’s History page.

The user’s published mileage displayed on the Admin account can also be downloaded to PDF or Excel. This is especially useful when discussing your clients or employees mileage claims as you can both see, in real time, exactly what trips have been claimed for.

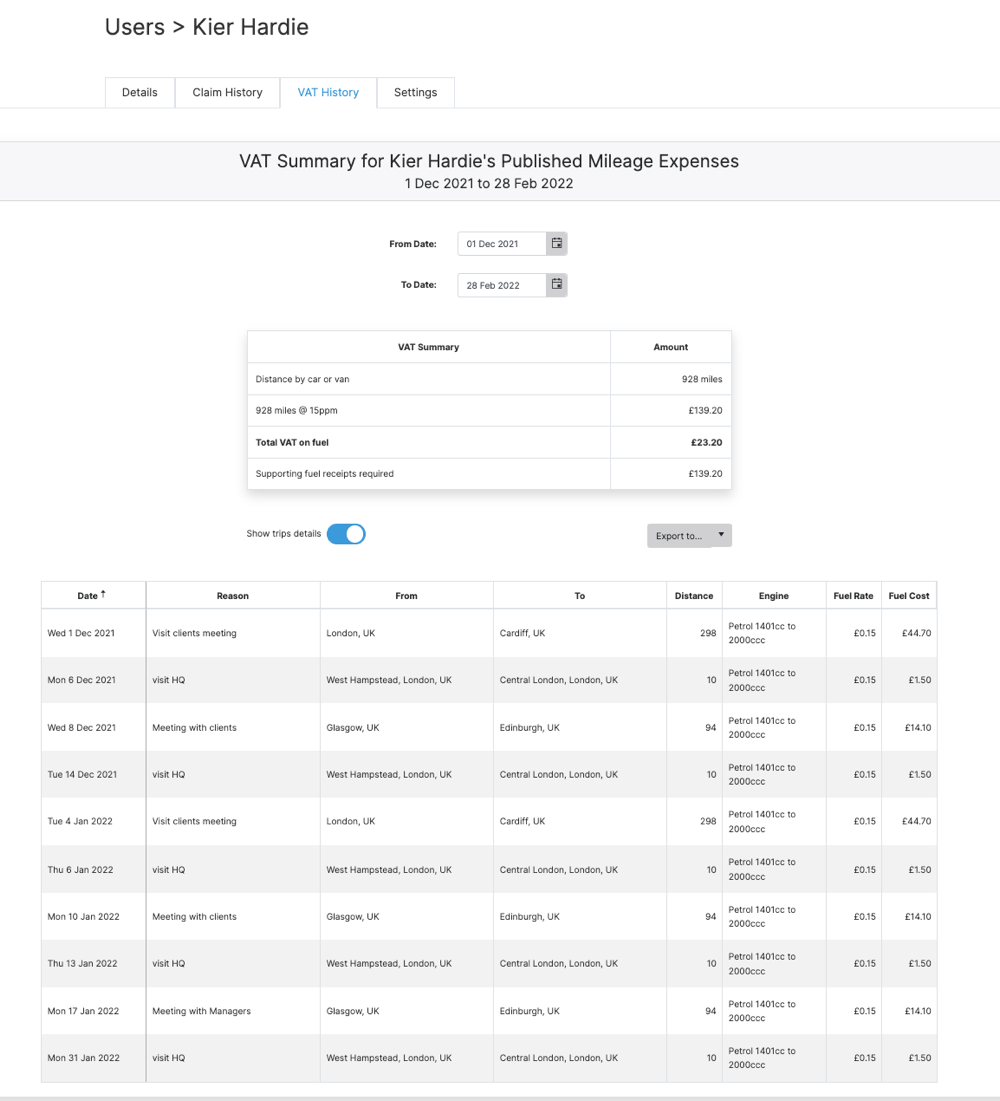

VAT on Mileage

The dashboard provides you with visibility of your users VAT on mileage.

Calculating the VAT on mileage is time consuming, and Tripcatcher does this automatically for those who claim VAT (not flat rate). We don’t just make mileage tracking easier but help with the entire process down to calculating VAT.

The dashboard allows you to drill down into the published details enabling you to see both a summary of the VAT claim and the detailed trips that make up the claim. Tripcatcher also shows you the amount of fuel receipts needed, helping you be HMRC compliant.

User Settings

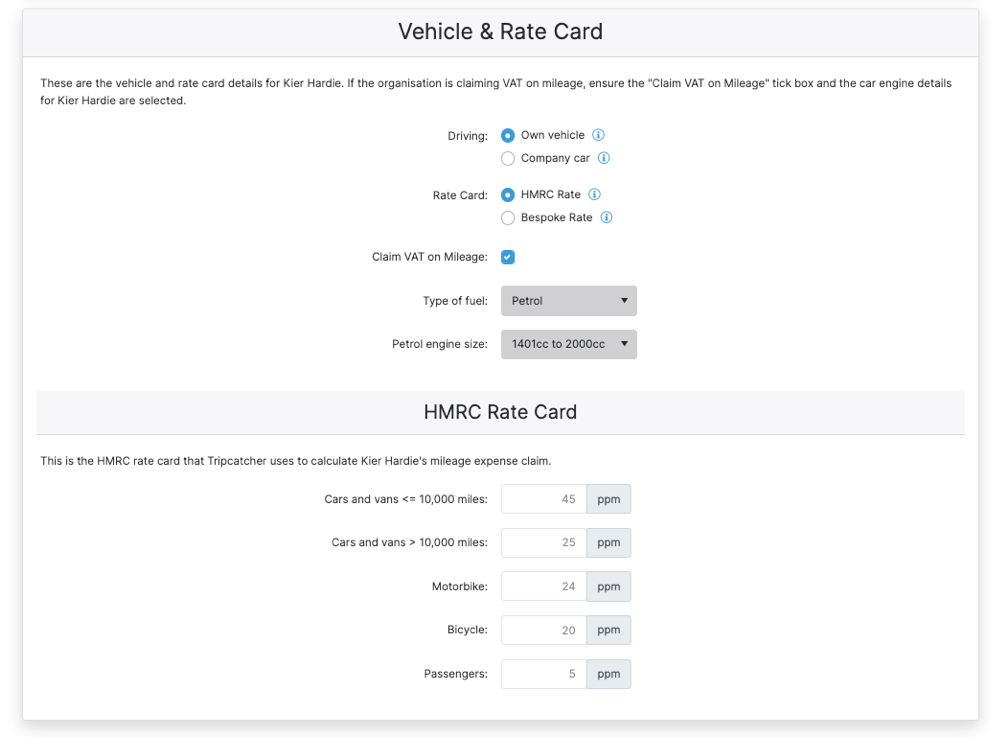

From the Admin account you can ensure your users are claiming the right rates for their business mileage, whether that be:

- a private vehicle using HMRC recommended rates, ie 45ppm for car and van mileage for the first 10,000 miles and 25ppm for >10,000 miles

- or the Advisory Fuel Rate/Advisory Electric rate for company cars

- or a totally bespoke rate

You can also ensure your users are claiming VAT on their mileage if they are eligible, which can save your company or clients £££’s.