These instructions give an overview of how to use Tripcatcher to record and claim your mileage expenses. Videos on how to save trips through the web app can be found here.

1. Add business trips

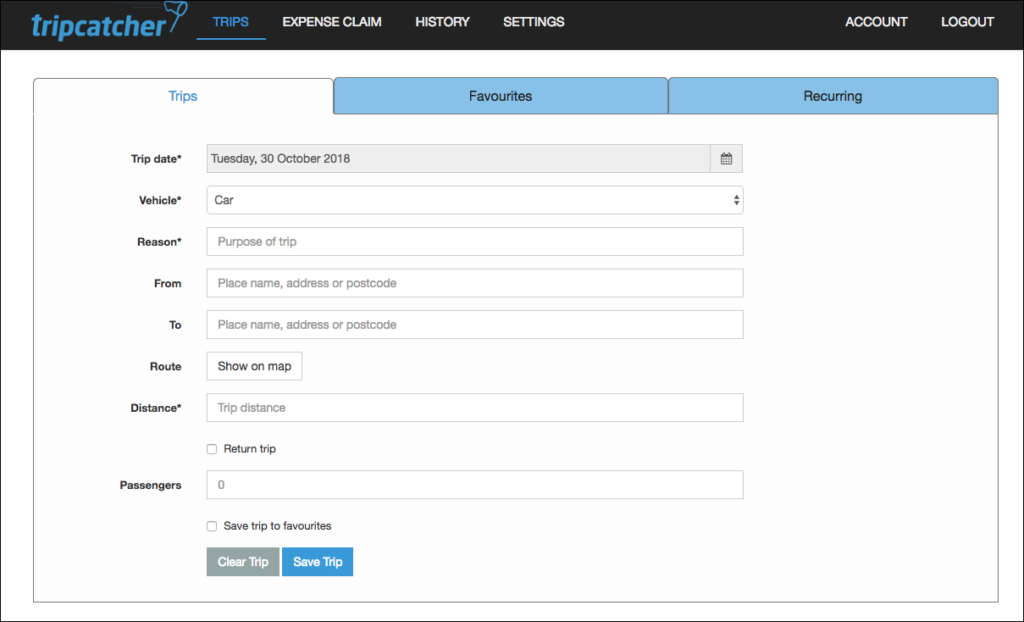

Your business trips can be saved from your Tripcatcher web app using the Add Trip form.

Or trips can be saved through your Tripcatcher phone app, iOS and Android. The phone app has both the Add Trip form and also GPS for recording your business mileage. To use the GPS press the start button at the start of the journey and the stop button at the end of the journey.

2. View saved trips

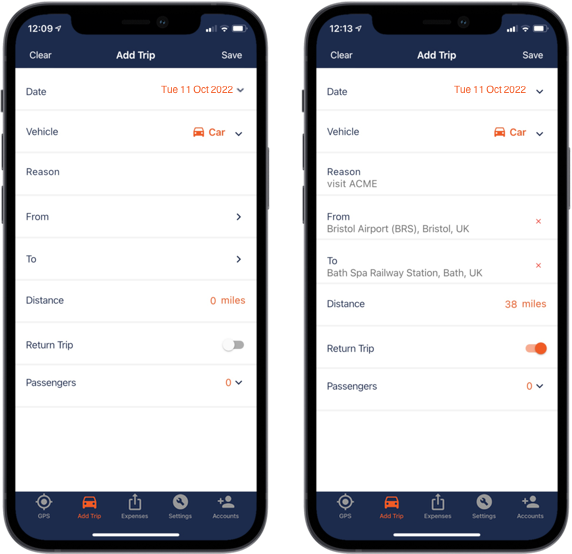

All saved trips, saved either from the phone app or the web app, are saved to the Tripcatcher Expense Claim page on the phone app and the web app.

The Expense Claim page shows all your trip details including the calculations of the claim.

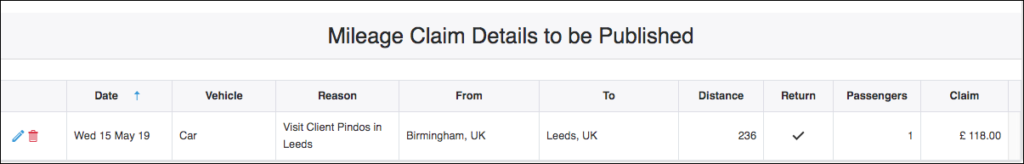

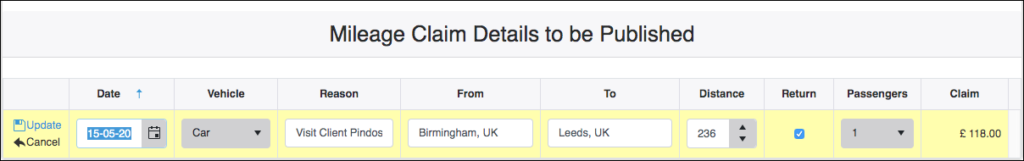

The Web App

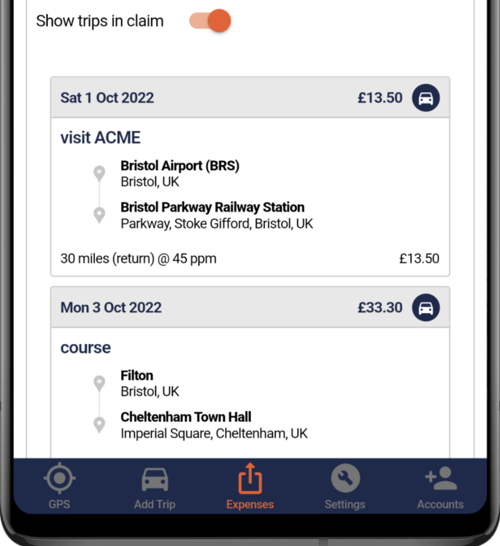

The Phone App

3. Review and submit your mileage

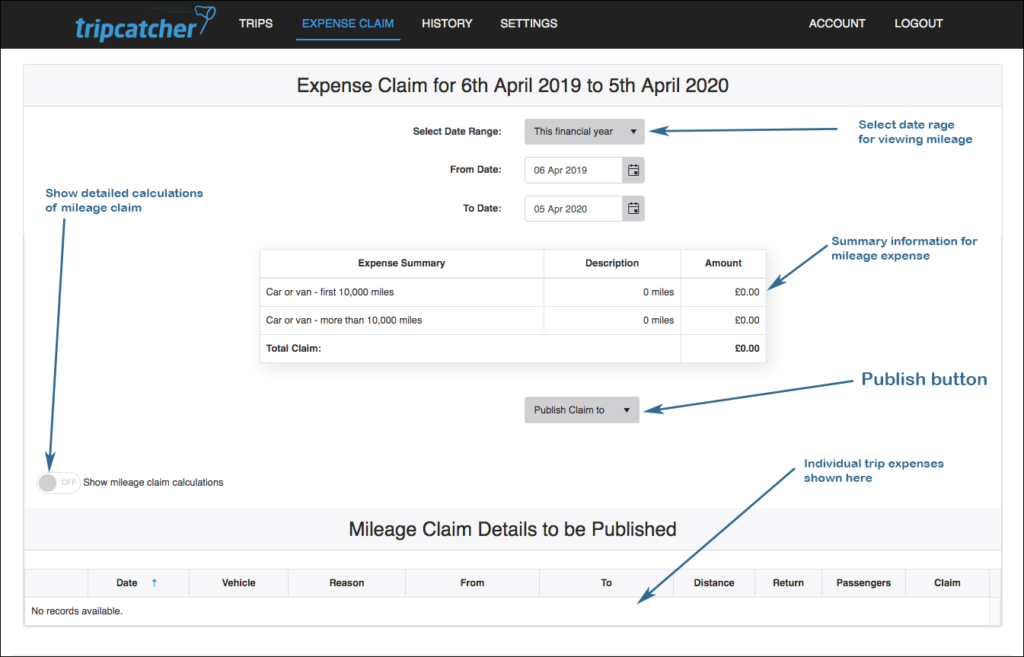

The Expense Claim page is where you can review your mileage expenses and submit your mileage expense claim.

The Web App

When reviewing your saved mileage, if you spot an error, you can edit the trip; you can also delete the trip. To delete a trip click on the red dustbin icon. It’s very easy to edit a trip, click on the blue pencil icon to the left of the trip, and you can now change the trip details to correct your mistake.

To save the edited trip details, click the update button. The mileage expense will be re-calculated and updated.

The Phone App

On the Expense Claims page you can easily see your individual trips; simply slide the orange switch to on to show all trips in the claim.

If you spot an error you can delete the trip and re-enter. To delete a trip simply slide to the left and you will be asked to confirm the delete.

4. Choose where to publish to

It is from the Expense Claim page that you also publish your mileage to the Printer, Excel, PDF, Xero or Dext.

If publishing to Xero or Dext your Tripcatcher account needs to be connected to your Xero or Dext account before you can publish. This may be done for you by your accountant/bookkeeper or employer; or you may need to do this yourself. If doing it yourself follow instructions on the website Support pages.

5. Publishing to Xero or Dext

We do recommend that you publish at least monthly.

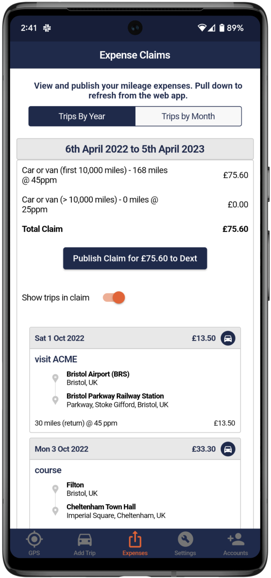

The Web app

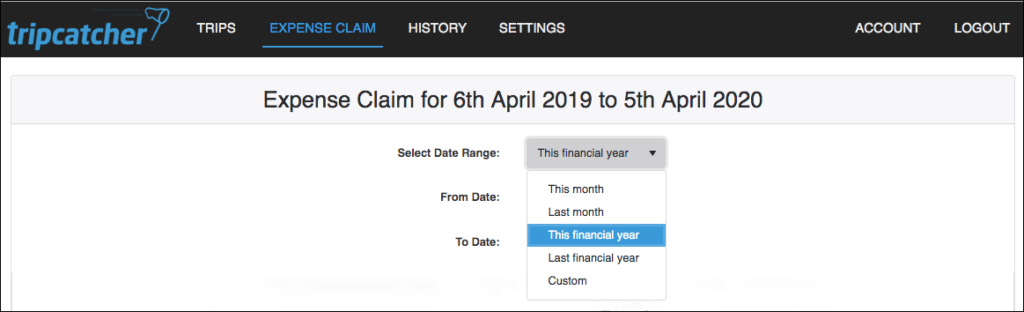

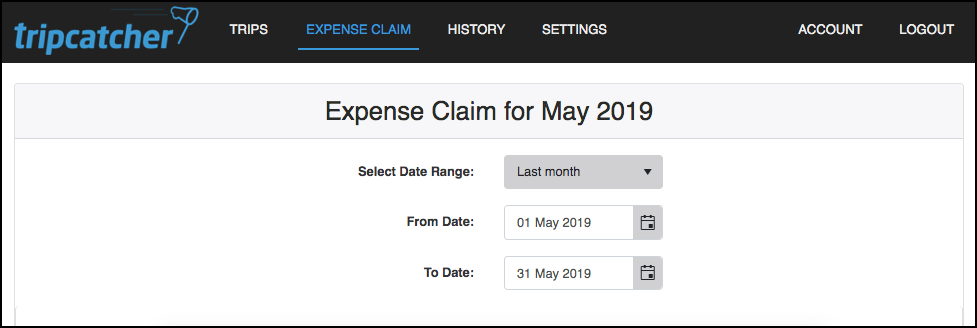

On the Expense Claim page you can select a Date Range of trips to be published. At the top of the page is a dropdown box which allows you to select a default date range, eg this month, or you can select a Custom date range.

Once the date range has been selected, click the Publish button. This will publish the selected mileage. Once successfully published you will get a message letting you know your mileage has been published successfully. The mileage will now appear on your Tripcatcher History page.

The Phone App

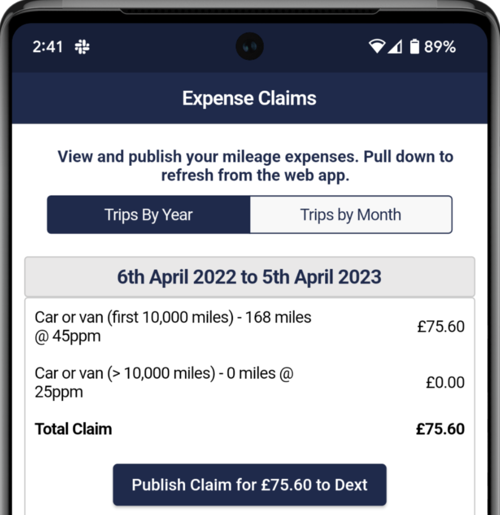

On the phone Expense Claims page you can publish mileage by personal tax year or by month; simply select the button “Trips By Year”, or “Trips By Month”.

Once the trip range has been selected, click the Publish Claim button. This will publish the selected mileage. Once successfully published you will get a message letting you know your mileage has been published successfully. The mileage will now appear on your Tripcatcher History page on the web app. It is on the road map to add the History page to the phone app.

6. Publishing to the Printer, PDF or Excel

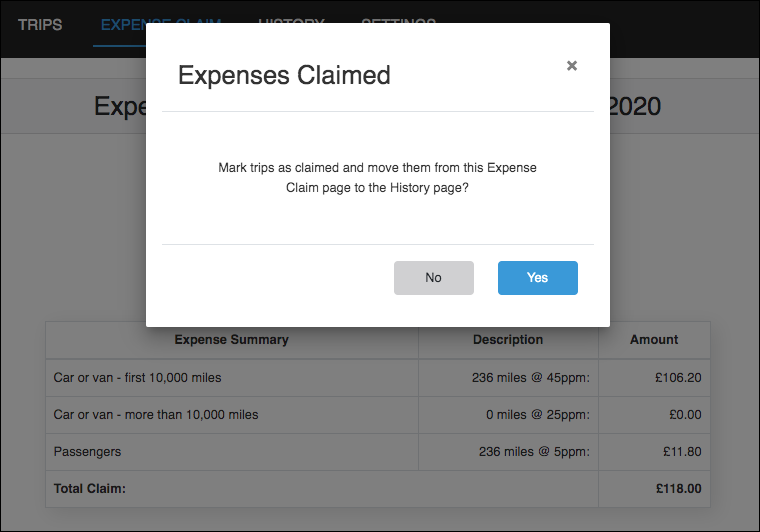

The instructions for publishing to the Printer, PDF or Excel are very similar to these for publishing to Dext or Xero, for both the web app and the phone app. We recommend that you publish monthly and you can now mark the published mileage as claimed.

If you mark the mileage as claimed, this mileage will appear on the Tripcatcher History page (on the web app only), and will no longer be displayed on the Expense Claim page. The date of publish is used as the claim date and this is displayed with the mileage details on the History page.

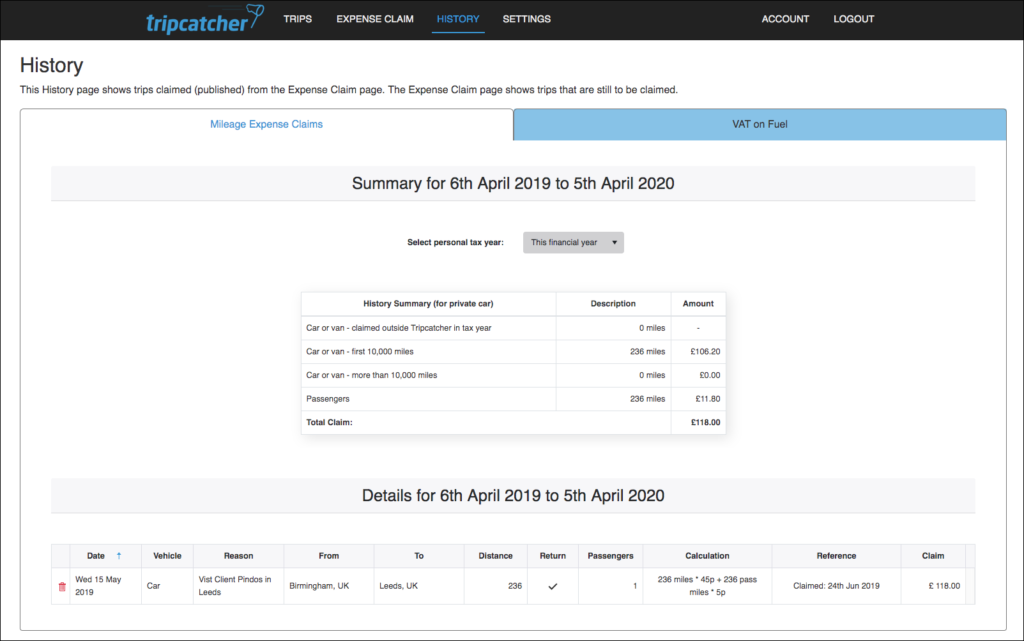

7. History

The History page contains all the trips published for this personal tax year year and also for last year. There are two tabs on the page, one for the actual trip claim information and one tab containing the VAT details if claiming VAT.

If you have any questions about using Tripcatcher please do get in contact with support@tripcatcherapp.com and we will be happy to help.