This guide explains how to set up Tripcatcher, to calculate the right mileage claim for you, when you drive an electric or hybrid car/van for business (as of 1st March 2024).

Privately Owned Electric or Hybrid Car

If you drive your own electric or hybrid car for business, then you can claim the HMRC Approved Mileage Allowance Payments (MAPS). As this is the default mileage settings in Tripcatcher there is nothing for you to change on the Tripcatcher Settings page.

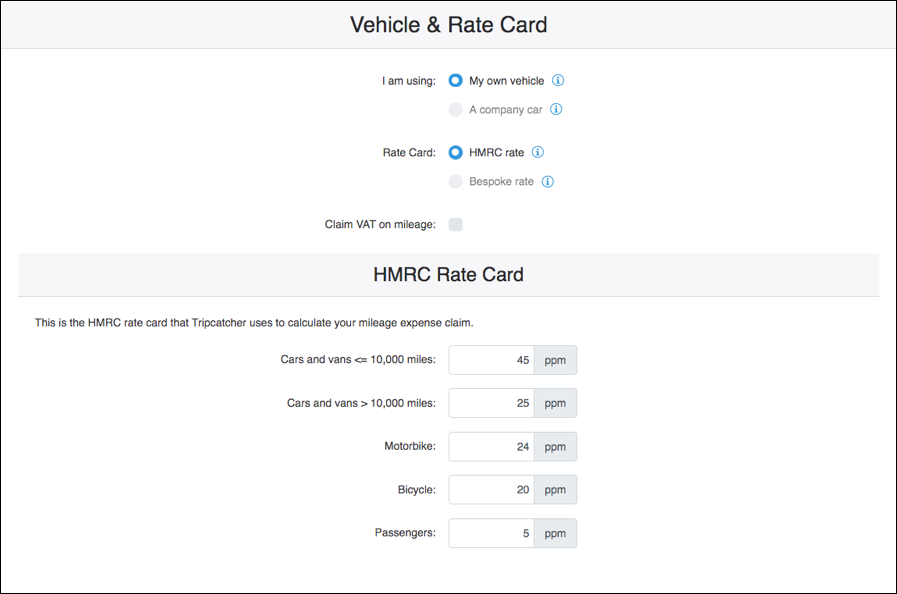

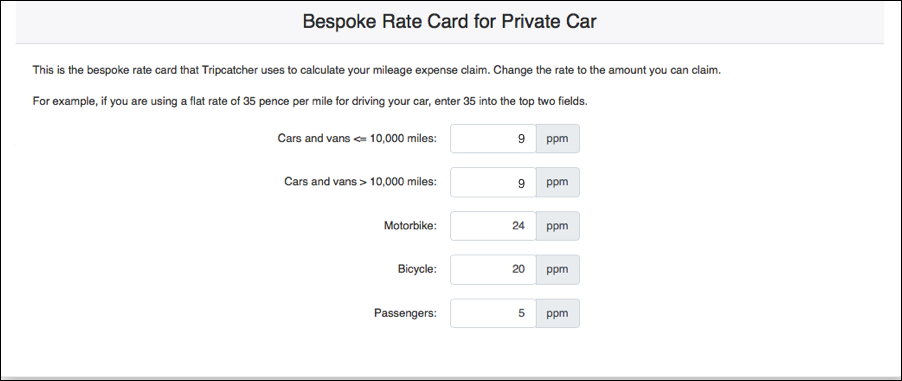

The image below shows the default mileage settings on the Tripcatcher Settings page.

Default Mileage Settings

Company Owned Electric Car

However, if you drive an electric company car then please follow these instructions (for company hybrid cars go to the next section).

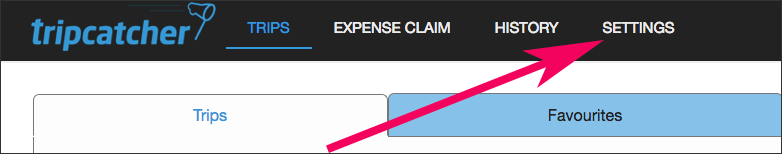

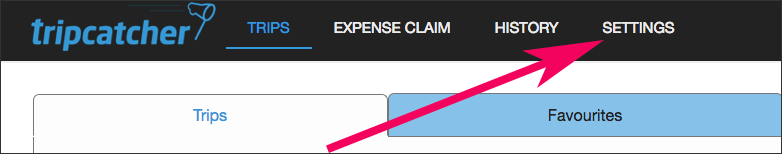

1. Settings Page

Open the “Settings” menu and scroll down the page to the Vehicle and Rate Card section.

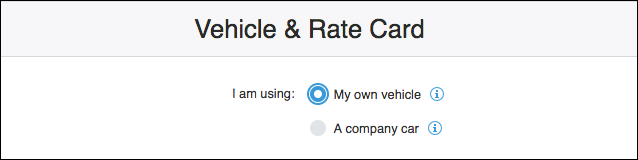

2. Vehicle and Rate Card Settings

The first selection is about the type of vehicle you’re using; when driving a company electric car or van for business travel then select My own vehicle (yes this is correct – do not select company car!). This is required as we do not currently have the Advisory Electric Rate setup in Tripcatcher.

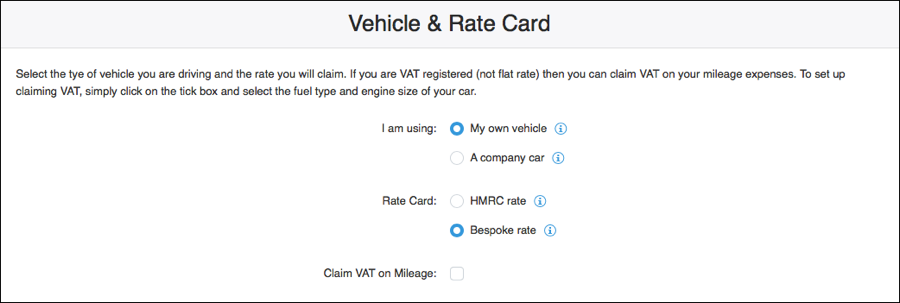

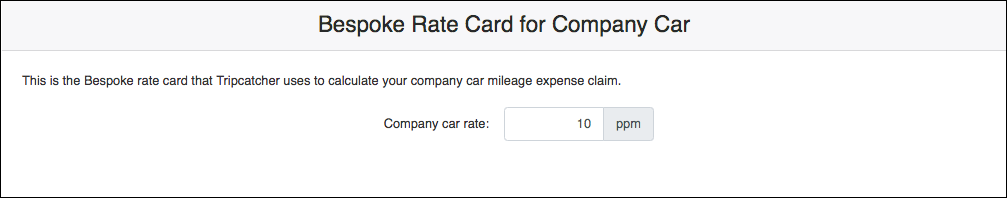

Your next selection is to set up the rate of 9p per mile (this is the Advisory Electric Rate set by HMRC from the 1st of March 2024). This 9ppm is a bespoke rate in Tripcatcher so select Bespoke rate.

When using Bespoke rates you will need to enter the actual rate of 9ppm into the Rate Card table. Ensure you enter both the under 10,000 miles rate as well as the over 10,000 rate. Otherwise, Tripcatcher will use the default rate for the mileage over 10,000 miles which is 25ppm.

Now your mileage settings and rates have been set up on the Tripcatcher Settings page for your company electric car, they will be used to calculate your future mileage claims.

Company Owned Hybrid Car

HMRC recommendations for claiming for a hybrid company car is to treat the hybrid car as either a petrol or diesel company car. As Tripcatcher has these petrol and diesel company car rates (Advisory Fuel Rates) setup these can be used for hybrid cars.

To set this up in Tripcatcher follow the instructions below.

1. Settings Page

Open the “Settings” menu and scroll down the page to the Vehicle and Rate Card section.

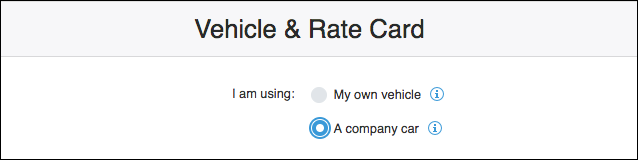

2. Vehicle and Rate Card Settings

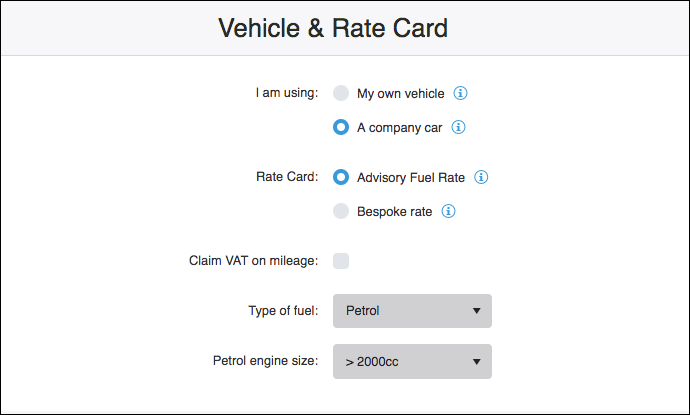

This first selection is about the type of vehicle you’re using; when driving a hybrid car or van for business travel then select A company Car.

The next selection is the mileage rate you’re using. This can be the HMRC’s Advisory Fuel Rate. Or if you’re paid a different rate then select Bespoke rate.

Next you need to select the Type of fuel (eg petrol or diesel) and Engine size of your car to ensure the right rate is used.

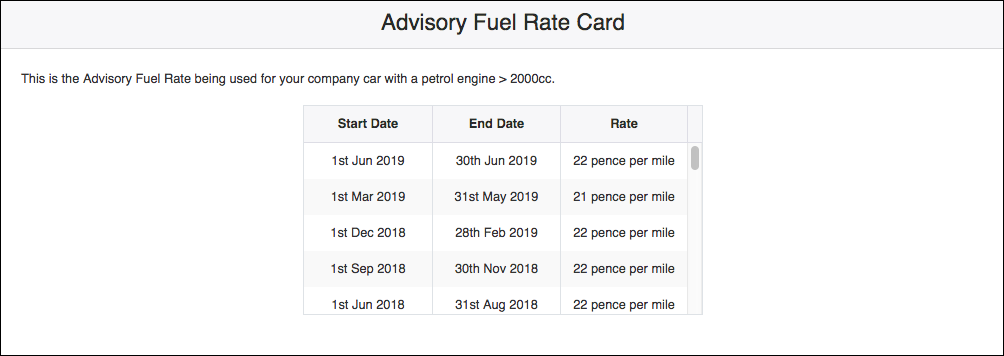

3. Advisory Fuel Rates

When using the Advisory Fuel Rate the Rate Card table will contain the rates that will be used by Tripcatcher for your vehicle. These cannot be changed.

When using a bespoke rate you will need to enter your actual rate into the Rate Card table.

Now your mileage settings and rates have been set up for your company hybrid car, they will be used to calculate your future mileage claims.

If you have any questions about setting your the mileage rate for your electric vehicle please do get in contact with support@tripcatcherapp.com and we will be happy to help.