Tripcatcher works for company car drivers who claim their business mileage, as well as those who use their own vehicles for business.

Tripcatcher also allows bespoke rates for both personal and company vehicles. The types of vehicle and the actual mileage rate to be used are set up on your Tripcatcher Settings page.

If you drive your own car for business and claim HMRC rates, there is nothing for you to change as this is the default setting for Tripcatcher users. However, if you drive a company car or claim a bespoke rate then please follow the instructions below.

More information on mileage rates can be found here.

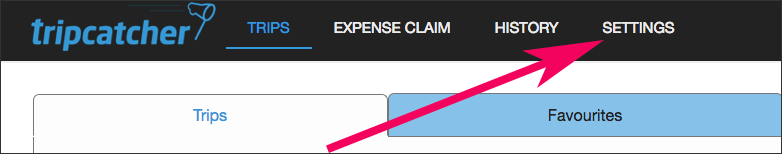

1. Go to Settings

Open the “Settings” menu and scroll down the page to the Vehicle Rate Card section.

2. Configure Settings

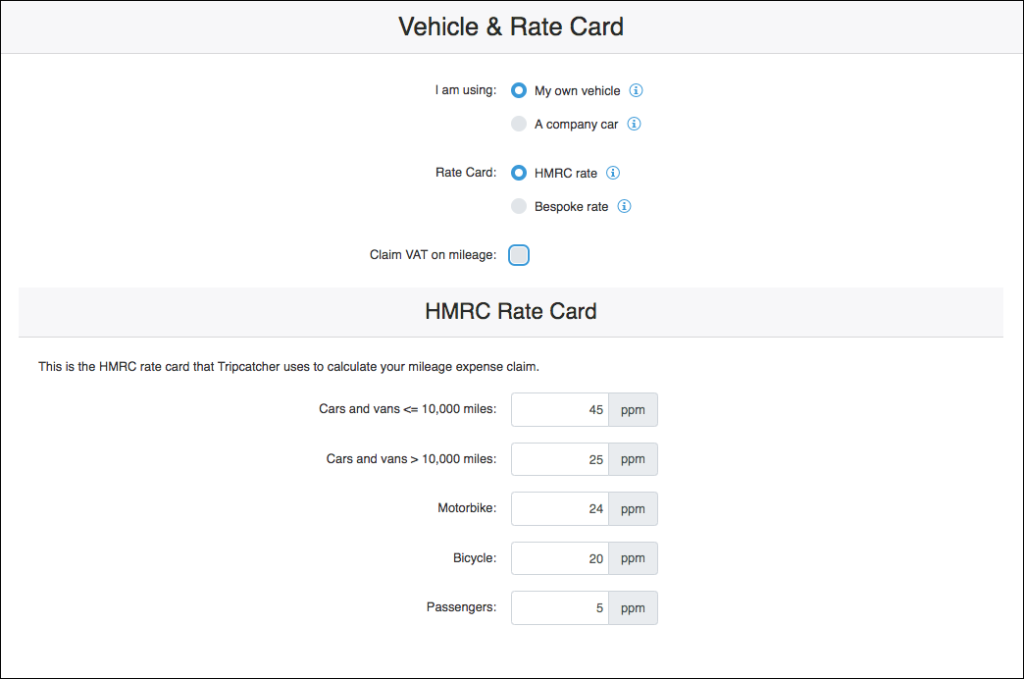

All vehicle information is setup from the Vehicle Rate Card section.

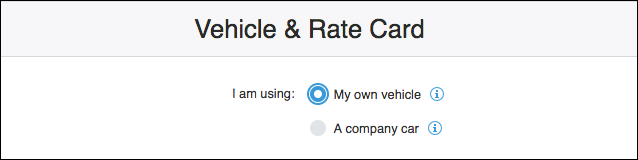

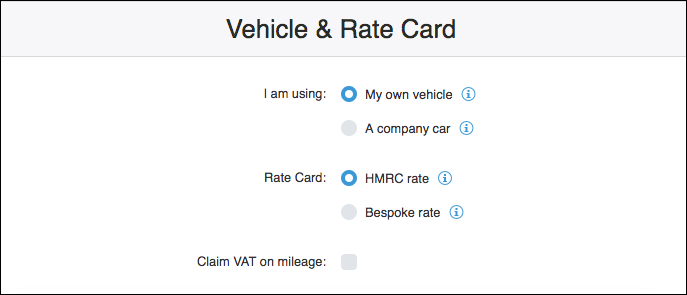

3. Driving your own vehicle

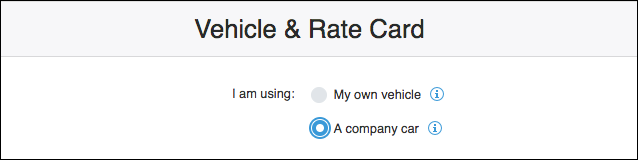

The first selection is about the type of vehicle you’re using, if using you own car, van, motorbike or bike for business travel then select My own vehicle. If your driving a company car then go to section 5.

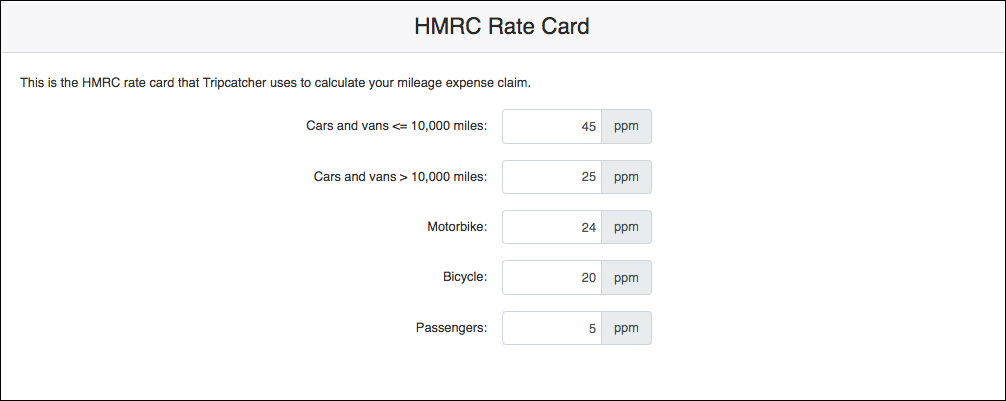

When using your own vehicle for business, your next selection is the mileage rates you’re using. This can be the HMRC recommended rates eg 45ppm for a car or van reducing to 25ppm after 10,000 miles. Or, if you’re paid a different rate, select Bespoke rate.

4. Rate Card

When using HMRC rates, the Rate Card table will contain the rates that will be used by Tripcatcher. These cannot be changed.

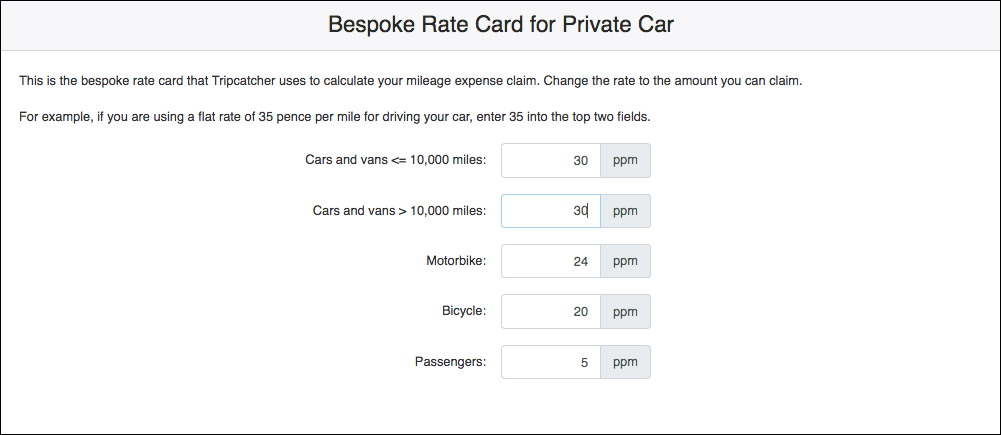

When using Bespoke rates you will need to enter your actual rate(s) into the Rate Card table. If you’re driving your own car then ensure you enter both the under 10,000 miles rate as well as the over 10,000 rate. Otherwise Tripcatcher will use the default rate for the over 10,000 miles which is 25ppm.

5. Company car

If driving a company car for business then select A company Car.

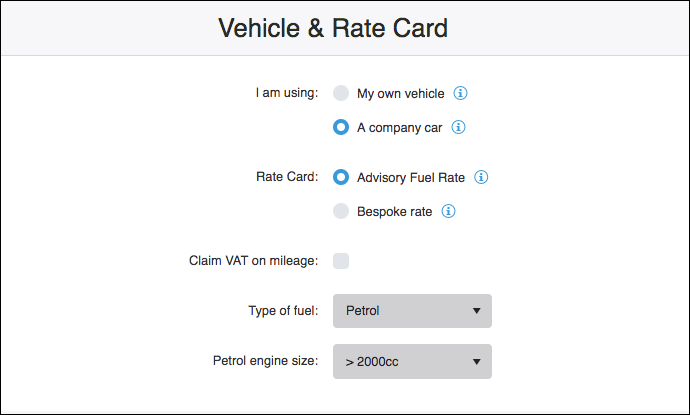

The next selection is the mileage rate you’re using. This can be the HMRC’s Advisory Fuel Rate. Or if you’re paid a different rate then select Bespoke rate.

If you chose the Advisory Fuel Rate (AFR) then you need to select the Type of fuel and Engine size of your car to ensure the right AFR is used.

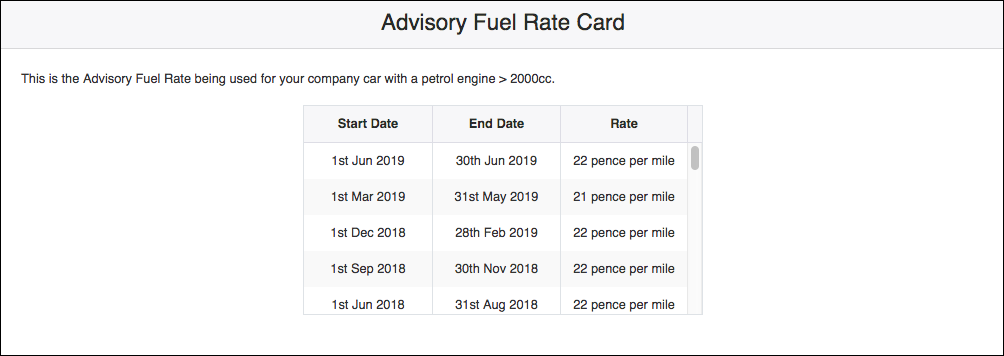

6. Advisory Fuel Rates

When using the Advisory Fuel Rate the Rate Card table will contain the rates that will be used by Tripcatcher for your vehicle. These cannot be changed.

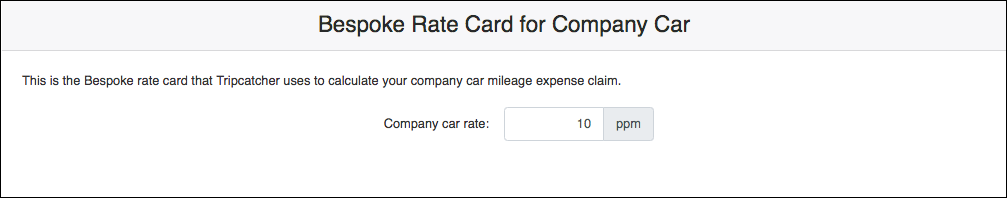

When using a bespoke rate you will need to enter your actual rate into the Rate Card table.

The selections and changes you make on the Tripcatcher Settings page are automatically saved; you will see a green banner at the bottom of the settings page letting you know your changes have been saved

Once your mileage settings and rates have been set up on the Tripcatcher Settings page, they will be used to calculate your future mileage claims.

If you have any questions about setting your mileage rate please do get in contact with support@tripcatcherapp.com and we will be happy to help.