Getting Started

Q. If I have a question, how do I get an answer ?

Have a look through these FAQs. If you can’t find the answer to your question, you can contact us in a number of ways:

- Send an email to support@tripcatcherapp.com;

- Send a message from the Contact page.

Q. What are the different types of Tripcatcher Account ?

Tripcatcher has 2 different types of Account:

- The Individual Account;

- The Partner Account.

The Individual Account

This is a single user account perfect for you the freelancer, director, or contractor. This is the main type of account and sends your mileage to Xero, Dext, Excel or to PDF with minimum effort. To find out more visit the Individual Account page.

The Partner Account

This is the multi user version of Tripcatcher. Perfect for a small business, accountant or bookkeeper. This account has the functionality of the Individual account with the extra functionality of the “Users” Dashboard. The Dashboard allows you to invite clients/employees to use Tripcatcher ( these are Individual accounts). To find out more visit the Partner Account page.

Q. How much does each type of Account cost?

All Tripcatcher accounts are £1.49 + VAT per month per user. However there are some extra conditions for some account types.

The Partner account is a multi user account and has a minimum number of 2 users. Hence the minimum price is £2.98 + VAT per month.

If you wish to save money on the Individual account; there is a 16% saving if you sign up for the year – the cost is £15 + VAT for the year. This is only for the Individual account.

Q. How do I sign up for a Tripcatcher account ?

Go to the Tripcatcher Pricing page, and click the “Sign Up Now” button for the product you wish to try. You will be taken to a popup where you can enter your details. There is an automatic 14 day trial for every Tripcatcher product, however you do need to enter your payment details on signup.

Or click on any of the “Start Your 14 Day Trial” buttons on the Tripcatcher pages.

Any questions about signing up please do get in contact with us at

support@tripcatcherapp.com.

Q. How do I activate my Tripcatcher account ?

When you sign up, or you’re invited by your accountant/bookkeeper or employer, Tripcatcher will send you an email. There is an ‘activation’ link in the email. Click the link and your account is activated. If the link does not work, copy and paste it into the browser.

The email should arrive within half an hour, generally it’s within a few minutes. If you do not receive the email check your junk and spam folders for a message from tripcatcherapp.com. Because you have not received an email from tripcatcherapp.com before and because the email contains a link, some email services (e.g. Gmail) may consider it junk mail.

If you do not find the email in your spam or junk folder then:

- If you’ve signed up yourself – send an email to support@tripcatcherapp.com and ask for the invite to be sent again.

- If you were invited to join Tripcatcher – get in contact with the person who sent you the invite and ask them to re-send.

Q. I have registered for a Tripcatcher account but I have not received an activation email. What should I do ?

The Tripcatcher invite email should arrive within half an hour, generally it’s within a few minutes. If you do not receive the email check your junk and spam folders for a message from tripcatcherapp.com. Because you have not received an email from tripcatcherapp.com before and because the email contains a link, some email services (e.g. Gmail) will consider it junk mail.

If you do not find the email in your spam or junk folder then:

- If you’ve signed up yourself – send an email to support@tripcatcherapp.com requesting a re-send.

- If you were invited to join Tripcatcher – get in contact with the person who sent you the invite and ask them to re-send.

Q. How do I reset my password for using Tripcatcher on the web and my phone app ?

The web app (using Tripcatcher through your browser) and the phone app share the same password.

To change your password (for both the web and phone app) go to the Tripcatcher Login form (on the web app), and there is link to reset your password.

Click the link on the login form and an email will be sent to you at your Tripcatcher email address. This contains a link to re-set your password; click the link and you will be taken to a web screen to enter your new password. If the link does not work, copy and paste it into the browser.

The email with the password link should arrive within a few minutes. If you do not receive the email check your junk and spam folders for a message from @tripcatcherapp.com. If you do not find the email in your spam or junk folder then send an email to support@tripcatcherapp.com requesting a re-send.

Q. What information do I need to know when setting up my account ?

Once you have activated and logged into your Tripcatcher account, a wizard will help you enter the information required. For the Individual Account this information is:

- The mileage you have already claimed for the current tax year, but not recorded in Tripcatcher. (This is used in the 10,000 mile calculation);

- If you are VAT registered and what type of car you drive (Engine type eg Diesel >2000cc). This information is required if you wish to reclaim VAT on your mileage expenses;

- Where you wish to publish your mileage expenses to eg Xero, Receipt Bank or Printer;

- And finally, your credit card details.

Q. Which browsers does Tripcatcher work with?

Tripcatcher supports the latest version of the following desktop browsers:

- Chrome on the Mac and Windows;

- Edge on Windows;

- Safari on the Mac.

And the following browsers on mobile phones:

- Chrome on Android;

- Safari and Chrome on iOS.

Some features, such as publishing mileage expenses to PDF or Excel may not work on your mobile, depending on whether the required software is installed and configured on your phone.

Please note Internet Explorer is no longer supported.

If you have any questions on browser support, please send an email to support@tripcatcherapp.com.

Q. Is there a Tripcatcher mobile app, and what phones are supported ?

Yes, Tripcatcher has apps for both the iPhone and Android. You can find out more about the phone apps here.

Also, you can access Tripcatcher through your phones’ web browser (on the Android and iPhone). The Tripcatcher web app has been designed to be “responsive” so that it will fit on phones, tablets, laptops and desktops.

Q. Is there a Tripcatcher app for the iPad ?

Currently, we do not have a Tripcatcher app for the iPad or for tablets. Tripcatcher will work on the iPad, or Android tablet, through the browser; Tripcatcher was designed to work in a browser on a phone, notebook, laptop and desktop. There is a Tripcatcher phone app for the Android and iPhone.

Q. I have more than one email address, does it matter which one I use to sign up to Tripcatcher ?

If you are signing up for an Individual account the email address does not matter. If you’re signing up for a Partner account then you must use a business email address, with its unique domain name. You cannot sign up for a Partner account with a Gmail, or Hotmail email address.

Q. How do I change my email address ?

Please contact us directly at support@tripcatcherapp.com and we will change your email address for you.

You will be required to be logged out of your web account when we make the change; when you get in contact please do confirm that you are logged out of the web app.

We will then get back in contact once changed.

Q. How do I cancel my Tripcatcher account ?

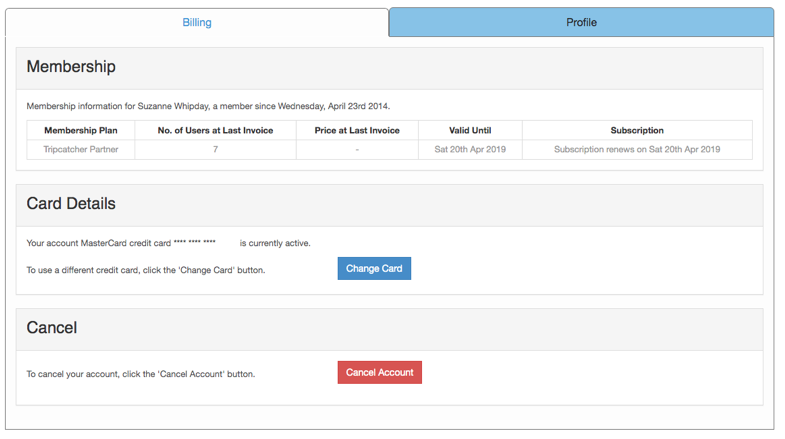

You can cancel your subscription at any point, without any cancellation fees. Login to your Tripcatcher account, go to the Account tab, the ‘Billing’ tab should be selected, click on the “Cancel Account” button and this will cancel your account.

The cancellation will take effect at the end of the billing period. If you cancel part way through your billing month, you will be able to use Tripcatcher until the end of that billing month.

Q. I have a new credit/debit card - how do I change my card details in Tripcatcher ?

It’s really easy to change the credit card details in Tripcatcher, you will need to log into your Tripcatcher account, go to the Account tab.

Click on the “Change Card” button and Stripe (our payment service) will take your new card details.

Using Tripcatcher

Q. How do I use Tripcatcher to claim my mileage expenses ?

Tripcatcher enables you to save your business mileage through your phone or web app. Once your mileage is saved you can view and submit your mileage through both the Tripcatcher web app and phone app. Here are the instructions on how to use Tripcatcher to save your mileage and submit your mileage expense claims.

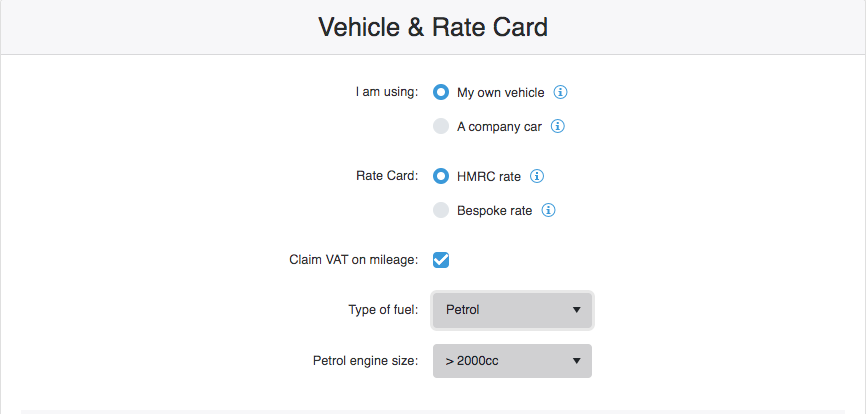

Q. I drive a company car, can I use Tripcatcher ?

Yes, Tripcatcher can be used to claim mileage for company car drivers. Tripcatcher lets you claim the HMRC Advisory Fuel Rates or claim a bespoke rate. This information is configured on the Tripcatcher Settings page.

The following instructions provide a step by step guide on how to set up the correct mileage rate(s).

If you are still having problems after reading this FAQ then please do get in touch, send an email to support@tripcatcherapp.com stating your problem and we will get in contact as soon as we can.

Q. My car is changing to a company car, do I need a new Tripcatcher account ?

You do not need a new Tripcatcher account; you can do this with your existing account. Just change your car details on the Tripcatcher Settings page (see instructions for changing your vehicle to a company car).

Your Tripcatcher History page will only display either private car mileage or company car mileage, the History page cannot display both at the same time. However all your mileage information is kept. To see your previous mileage claims, change your vehicle settings (on the Tripcatcher Settings page) page back to your original vehicle.

Q. Can I claim for passengers ?

Yes, you can claim 5 pence per mile per passenger providing your passengers are employed by the same company as you. Tripcatcher provides an easy way to claim for one or more passengers, both on the web and phone app.

N.B. You can only claim for passengers if you were driving a car or a van.

Q. Can I enter parking and tolls in Tripcatcher ?

Unfortunately Tripcatcher does not allow you to enter parking or toll information.

However, both Xero and Receipt Bank can take photos of parking and toll receipts, upload photos of the receipts to your bookkeeping service and allocate the VAT correctly. For those that already have one of these tools we recommend you use them for parking and tolls.

Q. I can only enter whole miles (not decimals) when adding a trip why ?

Tripcatcher uses whole miles when calculating mileage expenses; hence Tripcatcher restricts data entry to whole miles. One of the reasons Tripcatcher uses whole numbers is so the mileage can be submitted to Xero or Receipt Bank using their respective Expense APIs. By passing a whole number as the quantity of the mileage and the mileage rate (e.g. 45) as the unit price, then the Expense API can handle the mileage claim as an expense.

The verbal advice we’ve had from HMRC is that mileage can be entered to a decimal point or rounded to the nearest whole number. HMRC also said the treatment should be consistent and in the client’s favour. We’ve written to HMRC asking for the advice to be confirmed in writing, or that HMRC add the information to the HMRC website. (They’ve acknowledged that guidance on rounding trip distances is not on the HMRC website).

The Tripcatcher distance calculator (where you enter the to and from locations) rounds to the nearest integer, 1.9 is rounded to 2 and 1.4 is rounded to 1.

Q. Can I edit a trip once it's saved and appears in the Expenses page ?

Once a trip has been saved to the Tripcatcher Expense Claim page, you can edit or delete a trip on the web app. On the phone app you can only delete the trip

To edit a trip, from the web app, click on the pencil icon, to the left of the trip, and this will allow you to edit all the details except the claim amount. Click in the box of the item you want to change and then make the changes. Once completed click on the “Update” button and this will update the details including the claim amount. If you don’t want to save the changes click on the “Cancel” button.

To delete a trip click on the Dustbin icon, this will ask you to confirm that you want to delete the trip. Click “Yes” to delete the trip and “Cancel” if you don’t want to delete the trip.

Q. Can I delete a favourite trip?

A favourite trip can be deleted from Tripcatcher but only through the phone app.

On your Tripcatcher phone app go to the Settings>Favourite> Trips page, and slide the trip to the left. A delete icon will appear, click on “Delete” and you will be asked to confirm you want to delete the trip. Select “Yes” and the favourite will be deleted from the phone app and also the web app.

Q. How do I delete a published trip ?

A published trip will need to be deleted from Tripcatcher and also from your accounting system (Xero or Dext). The instructions below show how to delete a published trip from Tripcatcher.

You will also need to delete the same trip from your accounting system otherwise the two systems will be out of sync.

- Login to Tripcatcher through a browser (not the phone app);

- Go to the History page and locate the trip;

- Click on the Dustbin on the right hand side of the trip information;

- This will bring up the delete confirmation box, click the “Delete” button and the trip will be deleted in Tripcatcher;

- The Tripcatcher mileage counter (on the settings page) will also be updated with the new mileage, as will the History page summary.

Q. Can Tripcatcher be used by more than one employee in the same company ?

The simple answer is yes. However, each employee needs to have their own Tripcatcher account.

The reason for this is that Tripcatcher keeps a record of all mileage claimed for the user and once 10,000 miles is reached, the rate is changes from 45ppm to 25ppm.

Q. How do I change my account type eg I want to have a Partner Account ?

We do not have an automatic upgrade path at the moment. However, if you contact support@tripcatcherapp.com they will make this change for you.

Q. I drive 2 different cars for work, can I select the car I'm using when I record my trip ?

If you are not claiming the VAT on fuel, then the specific car you are driving does not matter.

However, if you are reclaiming the VAT on fuel then the car you are driving does matter. Tripcatcher does not support the use of more than 1 car when claiming VAT.

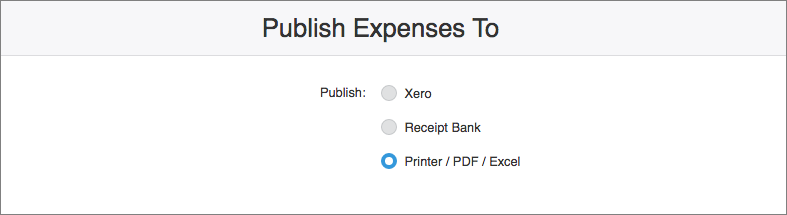

Q. I don't have Xero or Dext how do I print an Expense Report ?

To print an Expense Report go to the Settings page, ensure the “Publish Expenses To” selector is set to the Printer/PDF/Excel option.

Next go to the Expense Claim page and you will see the “Publish Claim to” button. Click on the arrow and a drop down list will appear with your options: Printer, Excel and PDF.

Click Printer from the list and this calls your browsers print functionality – from here you can print the Expense Claim to your printer.

You can also save the Expense Report to PDF or export to Excel.

Q. I want to show/print my mileage for April but I get an error message ?

Tripcatcher is based on the personal tax year (eg 6th April one year to 5th April the next). There are a number of reasons for this, one of which is that Tripcatcher resets the 10,000 mileage limit at the start of the personal tax year, ie on the 6th April.

To show/print a mileage claim that crosses the start of the personal tax year you will need to split the month in 2: the first part is from the period start (eg 1st April) to the 5th April, the second is from the 6th April to the period end date.

If you are still having problems after reading this FAQ then please do get in touch, send an email to support@tripcatcherapp.com stating your problem and we will get in contact as soon as we can.

Q. Can I change the reporting year in Tripcatcher to fit my company year rather than the personal tax year ?

Tripcatcher uses the HMRC personal tax year for calculating your cumulative mileage, this is so that Tripcatcher can change your mileage rate from 45 pence per mile to 25 pence per mile once you pass the 10,000 mile threshold. Every year, on April 6th this mileage counter is reset back to 0. Using this personal tax year has no impact on your business tax year or vice versa.

Your mileage expense reporting should be done from your accounting package and not from Tripcatcher. Tripcatcher is the means to enter your mileage and you accounting package is the means to report on your mileage.

We recommend trips to be published, from Tripcatcher, weekly or monthly and we also recommend that you publish your mileage expenses to your accounting package at your business year end. This will maximise the amount of cash you can withdraw from your business in that business tax year. The publishing of trips regularly is also important if you are reclaiming VAT, as the trips need to be published in the correct VAT quarter.

Also, in April, we suggest submitting one claim on the 6th April and the second at the end of April. This avoids having a claim span the personal tax year and keeps the accounts really tidy.

Claiming VAT on mileage

Q. How is the VAT calculated on my mileage claim ?

VAT can only be claimed on the fuel element of your mileage claim. We use the HMRC Advisory Fuel Rate to approximate the fuel element of your mileage claim. This rate depends on the engine size and fuel type of your car. The current Advisory Fuel Rates are listed below.

From the 1st March 2024 the Advisory Fuel Rates are:

| Engine Size | Petrol – pence per mile | LPG – pence per mile |

|---|---|---|

| 1400cc or less | 13 pence | 11 pence |

| 1401cc to 2000cc | 15 pence | 13 pence |

| Over 2000cc | 24 pence | 21 pence |

| Engine Size | Diesel – pence per mile |

|---|---|

| 1600cc or less | 12 pence |

| 1601cc to 2000cc | 14 pence |

| Over 2000cc | 19 pence |

To calculate the VAT, Tripcatcher takes the number of miles on your mileage claim and multiplies it by the relevant Advisory Fuel Rate and then multiplies the answer by 1/6.

Here is a worked example:

Peter travelled 200 miles on a return visit to a client. He is claiming 45ppm. The mileage claim is 200 * £0.45 = £90

Peter drives a 2200cc Diesel, which has a current Advisory Fuel Rate of 19ppm. Hence the VAT calculation is 200 * £0.19 = £38/6 = £6.33

In summary Peter can claim £90 for mileage expenses and claim £6.33 worth of VAT on the fuel element of the claim. He will need to keep a fuel receipt(s) for £38 for proof of fuel purchase.

For more information on claiming VAT on mileage please see our blog VAT on mileage expenses – how to claim.

Q. How do I set up Tripcatcher to calculate the correct amount of VAT on fuel ?

If you are VAT registered (not flat rate) then you claim the VAT on your mileage expenses. To set this up in Tripcatcher go to the Tripcatcher Settings page.

On the Tripcatcher Settings page click the “Claim VAT on mileage” box, in the Vehicle and Rate Card section. This will bring up a set of selection boxes; select the type of fuel your vehicle uses and the engine size of your vehicle – this information enables Tripcatcher to use the correct Advisory Fuel Rate (AFR). This AFR is used to calculate the fuel element of your mileage claim, and hence the VAT amount.

Now go to your Tripcatcher Expense Claim page and you will see the VAT information calculated on your business trips.

Q. How often does the Advisory Fuel Rate change ?

The Advisory Fuel Rates are updated by the HMRC every 3 months, and Tripcatcher is updated as soon as the new rates are published. The dates for changes are: 1st March, 1st June, 1st September and 1st December.

Q. I drive my own van, can I claim VAT on my work trips?

In Tripcatcher you can now claim VAT for trips made in your van. We have confirmation from HMRC that you can claim the VAT on mileage if driving your van for work.

Q. Do I have to keep all the fuel receipts, or just a sample ?

We recommend that you keep all the fuel receipts needed to cover your VAT claim, however you may wish to discuss this with your accountant.

Q. Does Tripcatcher capture/store fuel receipts for my VAT claim ?

Tripcatcher does not currently capture fuel receipts.

However, there are a couple of ways of capturing and storing your fuel receipts:

- Upload them to Receipt Bank and archive them – do not submit them, or

- Use the Xero phone app to take a photo of the receipt and upload the receipts to the files area of your Xero account.

Q. In Xero the VAT on the non-fuel element of my mileage claim is shown as zero rated. Is this correct ?

Yes, Xero’s recommendation is to allocate the non-fuel element as a zero rated expense. This will then appear on the Xero VAT report as required.

Q. I find the HMRC documentation confusing, do you have more information on how I claim VAT on mileage ?

Yes, we have a blog that takes you through the process – it’s called VAT on mileage expenses – how to claim.

Partner account

Q. What is the Partner Account?

The Partner Account

This is the multi user version of Tripcatcher. Perfect for businesses, accountants and bookkeepers. This account has all the functionality of the Individual account with the extra features of the “Users” Dashboard. The Dashboard allows you to invite clients/employees to use Tripcatcher (they are provided with Individual accounts). To find out more visit the Partner page.

Q. How much is the Partner account ?

The Partner edition of Tripcatcher costs just £1.49 + VAT per user per month (min 2 users). The pricing is per activated user (a user who has activated their Tripcatcher account) per month. The minimum price of the Partner account is for 2 users which is £2.98 + VAT per month.

For example, a Partner with 5 other users (ie 6 accounts) will cost £8.94 (6 * £1.49) + VAT. Admin users, including the Partner owner (the person who signed up for the Partner account) count as users and cost £1.49 + VAT per account per month.

Q. Does it matter which email address I use to sign up for a Tripcatcher Partner account ?

When signing up for a Partner account it is recommended you use a business email address, with its unique domain name. If you don’t have this then you can still signup with a gmail or equivalent email address.

Q. As a Partner, can I connect my users to their Xero or Dext accounts ?

If your Clients publish to Xero then there is a table on your Settings page that allows you to connect your users to Xero. See the Xero Integration FAQs for more information.

If your users are publishing to Dext then they need to connect themselves. This is really easy to do and there is more information about this on the Dext Integration FAQ page.

Xero Integration

Q. As a user, how do I connect my Tripcatcher account to my Xero account ?

Creating the connection between Tripcatcher and Xero can be completed in just a few clicks.

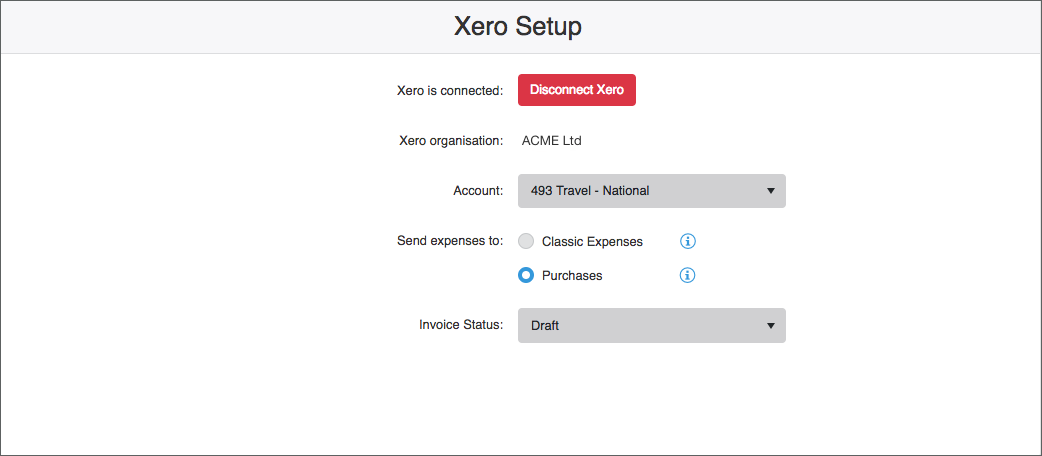

- In Tripcatcher, go to the Settings page;

- Select publish to Xero and click the “Connect Xero” button. This activates the connection to Xero;

- Enter your Xero login details, select your Xero organisation and click “Allow Access”;

- Once Tripcatcher is authorised to connect to Xero you are taken back to Tripcatcher;

- Select the Xero Account code for publishing your mileage expenses to. You now have the choice to publish to Xero’s Classic Expenses or Bills in Purchases (default for new connections);

- Your connection from Tripcatcher to Xero is now setup.

More detailed instructions can be found here.

Q. I have a Partner Account, does Tripcatcher automatically publish my users' mileage to Xero or do I need to do anything ?

Each Tripcatcher account needs to be connected to Xero, in order to publish mileage from Tripcatcher to Xero. This connection must be done by you the Partner. The following instructions provide a step by step guide on how to connect your users.

Once connected each user then needs to publish their own mileage. This is done from the Tripcatcher Expense Claim page by clicking the “Publish Detailed Claim to Xero”. The user can publish all mileage on the Expense Claim page or can select a date range of mileage to be published.

Q. As a Partner/Admin how do I connect my users to Xero ?

The connection, of a user’s Tripcatcher account to Xero, is managed from your Tripcatcher Partner Settings page. This is completed through the “All Users Xero Connections” table.

The connection table contains a list of all your users who have selected to publish to Xero. The table shows you if they are already connected to Xero, or if you need to connect them.

The following instructions provide a step by step guide on how to connect your users.

Q. How do I set/change the Xero Account Code for charging mileage ?

To change the Xero Account code, in your own Tripcatcher account, for charging mileage expenses to:

-

- From the Tripcatcher Settings page, go to the Xero Setup section where you will see all your Xero connection details;

- Click in the “Account” box and a dropdown list will appear containing all the Account codes that can be used;

- This list is imported from your own Chart of Accounts (if the code you want does not exist see FAQ below about missing Account codes);

- Select the code you want to use and this will now be automatically saved as your new Xero Account code for charging your mileage expenses to.

To change the Xero Account code, in your user’s Tripcatcher account, for charging mileage expenses to:

- From the Partner/Admin account go to the Settings page where the table of Xero connections is shown;

- For the individual user, click on the red Disconnect button. This will disconnect the current connection;

- You will be asked to confirm that you wish to disconnect the user – click the “Yes” button;

- You will now be taken through the connection steps where you can select the correct Xero Account code.

Q. When connecting to Xero and the mileage Account code is missing or the the Account code list is empty, how do I fix this ?

Tripcatcher imports the Account codes from Xero that have the flag ‘Show in Expense Claims’ set. Normally, this flag is set on the Expense Accounts in Xero. If this flag is not set the Account code will not appear in the Account list in Tripcatcher.

To set this flag:

- Log into your Xero account and Click on Accounting;

- Select Chart of accounts – this will take you to your Chart of accounts listing;

- Click on the Account you want to use to record your mileage expenses, this will open up the Edit Account Detail box;

- Set the ‘Show in Expense Claims’ checkbox and click Save.

Go back to your Tripcatcher account and you will need to re-connect to Xero (i.e. click “Add another Xero Organisation”, do not select from the organisation list) to bring back the new Chart of Accounts information from Xero.

If the Account code or list is still empty then send an email to support@tripcatcherapp.com

Q. I have a problem Connecting Tripcatcher to Xero, Xero says that I already have a connection to Tripcatcher

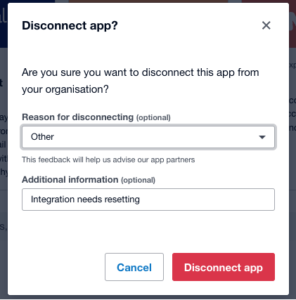

You will need to disconnect the Xero Connection to Tripcatcher in your Xero account.

- Please login to your Xero account;

- Select the Organisation of interest;

- Click on the down arrow to the right of the Organisation name;

- Click on Settings;

- Select Connected Apps;

- If your Xero account is connected to Tripcatcher click Disconnect;

- A popup box will be displayed (see image below). Select the reason for this disconnection as “other” and then in the “Additional Information” box add Integration needs resetting. Click the “Disconnect app” button;

- Now logout of Xero.

You should now be able to reconnect this organisation.

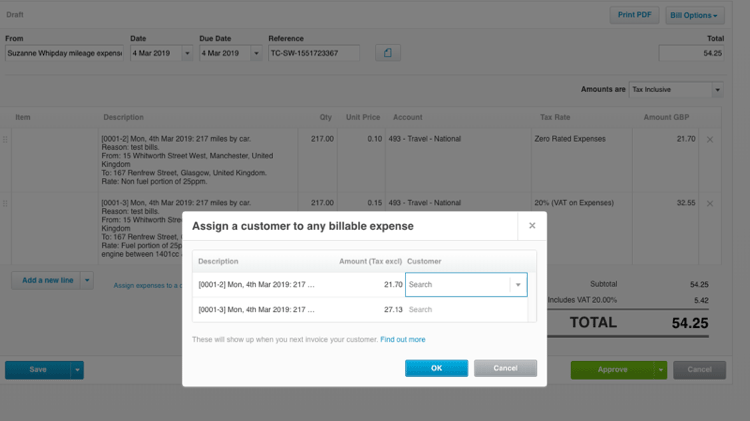

Q. Can I re-charge a Tripcatcher mileage expense to a client in Xero?

Currently, Tripcatcher does not capture information for re-charging mileage expenses to a client.

However, if you publish your mileage to Xero Bills, you can assign a client to this transaction in Xero. Simply click on the link “Assign expenses to a customer”, this brings up a popup box for you to enter the details.

Q. Does Tripcatcher allow "Tracking" of mileage to a project in Xero ?

Currently, Tripcatcher does not capture information for “Tracking” mileage and allocating that mileage to projects.

However if you publish your mileage to Xero Bills, you can assign a tracking option to this transaction in Xero. See Xero Help for more information.

Q. What are the reasons for connecting to Classic Expenses or to Bills in Purchases ?

The choice does depend on whether you are connecting yourself or another user.

If connecting yourself, you need Xero Standard Access to publish to Classic Expenses or to Purchases. There are also a few other things to consider:

- If your Xero organisation was created after July 10th 2018 you cannot use Classic Expenses and must publish to Purchases;

- If you want to re-charge the mileage to a client then you can do this easily through Purchases;

- If you want to allocate the mileage to a project then again, you can do this easily through Purchases;

- If claiming VAT on your mileage expenses you may want to publish to purchases. This is because the date of the bill is set to the date of the last trip published. This date will fit in with your VAT quarter. The date of the expense report in Classic Expenses is the date of publishing the mileage. This date may be outside of your VAT quarter.

If you are a Partner or Admin and connecting a user, you can connect all Tripcatcher users to Xero Purchases but only users who have a Xero login can be connected to Classic Expenses. Like above there are also a few other things to consider:

- If the users’ Xero organisation was created after July 10th 2018 then you cannot connect your user to Classic Expenses and must select Purchases;

- If your user wants to re-charge their mileage to a client they can do this easily through Purchases;

- If your user wants to allocate their mileage to a project, again they can do this easily through Purchases;

- If your user is claiming VAT on their mileage expenses then you may want to connect them to Purchases. This is because the date of the bill is the date of the last trip published. This date will fit in with your users VAT quarter. The date of their expense report in classic Expenses is the date of publishing the mileage. This date may be outside of your users VAT quarter.

Q. How often should I publish my mileage to Xero ?

We do recommend you publish your mileage to Xero at least monthly. This is especially important if you are claiming VAT on your mileage expenses.

If you business’s financial year is not the same as the personal tax year (6th April to 5th April), we recommend you publish your mileage claim before the end of your business tax year.

Q. I've saved Trips in Tripcatcher, both from my phone and my PC, but I cannot see them in Xero, am I missing something ?

Trips saved from the web app or phone app are saved to the Tripcatcher Expense Claim page on the web app and also the phone app. It is from here that they are published to Xero. However your Tripcatcher account must be connected to Xero before you can publish to Xero (see instructions on connecting Tripcatcher to Xero).

To publish your trips from the web app:

- Login to your Tripcatcher web app account;

- Go to the Expense Claim page where you will see all your trips;

- Click the publish button, underneath your summary information, and your trips will be published to Xero;

- Once published all these trips are moved to the Tripcatcher History page where you will see the publish confirmation id from Xero;

- You will also see your Tripcatcher mileage in Xero, either in Classic Expense under “Awaiting Approval” or in bills with the reference starting “TC-” and the date is set to the date of the last trip published.

Q. Does my Tripcatcher email address need to be the same as my Xero login email address ?

No, the 2 email addresses do not need to match. However, when connecting Tripcatcher to Classic Expenses you do need to connect Tripcatcher to a Xero account. When connecting Tripcatcher to Xero’s Classic Expenses Tripcatcher returns the email address(es) that matches your name. If more than 1 account you will need to select the correct Xero account from the returned list.

Q. Can I re-publish trips in Tripcatcher that have already been published to Xero in error ?

There is no automatic way of republishing trips to Xero without re-entering them. In Tripcatcher they will have been marked as published and the miles already added to your mileage total.

However there are a couple of things you can do:

- You can delete these trips from Tripcatcher and re-enter into Tripcatcher and then publish to the correct Xero account. To delete these trips go to the Tripcatcher History page and click on the red dustbin on the right hand side of each trip you wish to delete, then click to confirm the delete. This will adjust the mileage counter total. Then re-enter and publish as normal.

- The other option is to enter a summary journal in Xero for the trips you want to re-publish. This mileage information is already in Tripcatcher and will then be in Xero in summary form. You could also upload an image/file of the mileage into your Xero account as proof of the individual trips.

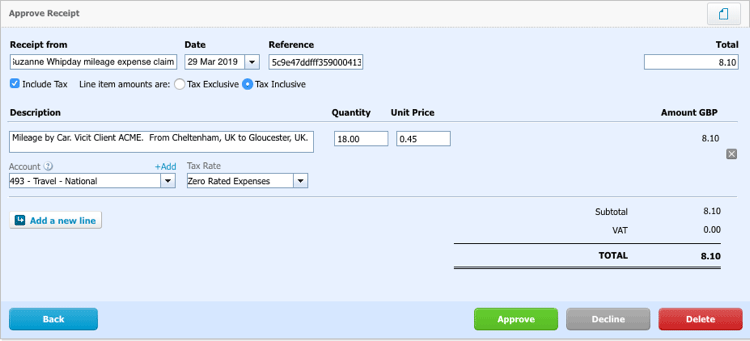

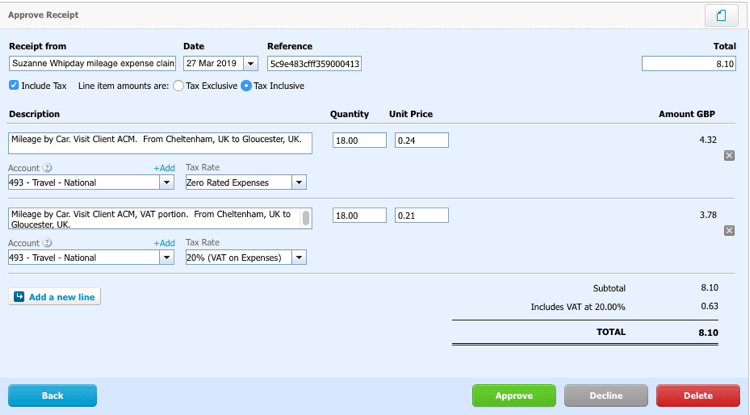

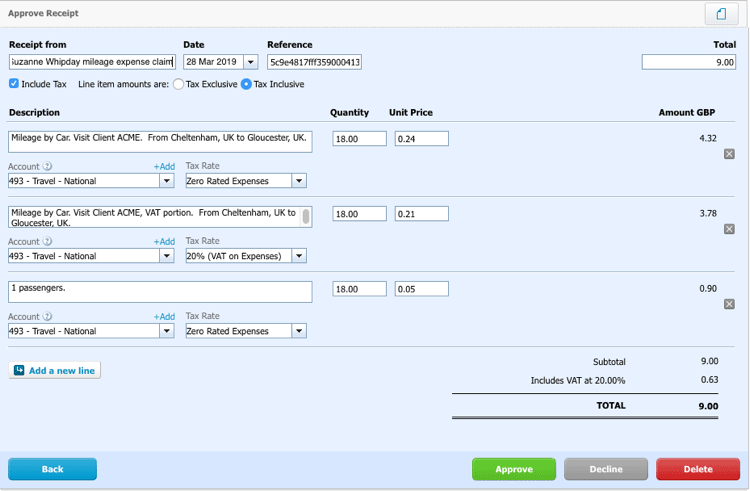

Q. What does a published trip look like in Xero's Classic Expenses ?

This does depend on what information you are publishing. If publishing a simple trip of 18 miles at 45ppm then it will look like the image below.

If you are reclaiming VAT on your mileage then the trip will appear in 2 line items – one line for the VAT portion and one for the non VAT portion (Zero Rated Expense in Xero).

If reclaiming for passengers, this information will also appear as a separate line item.

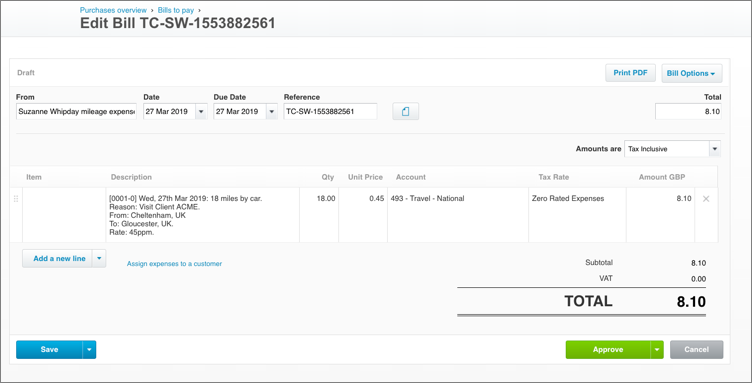

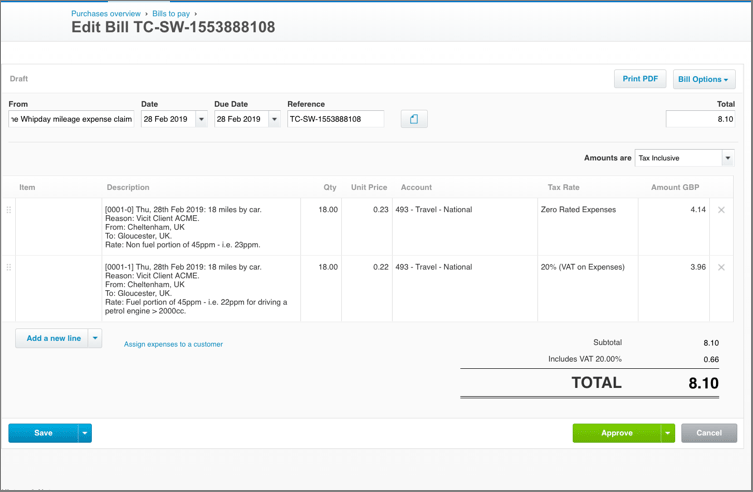

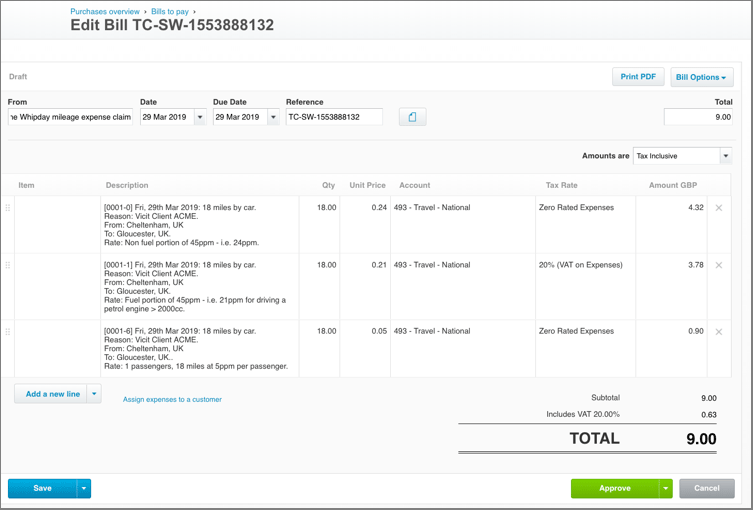

Q. What does a published trip look like in Bills in Xero's Purchases ?

This does depend on what information you are publishing. If publishing a simple trip at 45ppm then it will look like the image below.

If you are reclaiming VAT on your mileage then the trip will appear in 2 line items – one line for the VAT portion and one for the non VAT portion

If reclaiming for passengers these will also appear as a separate line item.

Q. When I publish trips to Xero, the trip comes through with no VAT rate selected - what can I do?

The Xero VAT box should automatically be populated with “Zero Rated Expenses” ; Tripcatcher sends the mileage data to Xero with the code “ZERORATEDINPUT” which is Xero’s code for Zero Rated Expenses. The Zero Rated Expense code then appears in the Expense in Xero.

To Note: Xero’s recommendation is to allocate the non-fuel element of the trip as a Zero Rated Expense, rather than No VAT. This will then appear on the Xero VAT report as required.

It looks like this is not set up in your Xero account. Can you please check that this code is/is not set up in your Xero Account:

- Login to your Xero account;

- Under the “Accounting” menu, select “Advanced”;

- In the Advanced page, select Tax Rates ;

- This will take you to the Tax Rates page where you can check if you have this code set up.

If you don’t have the code then please do get in contact with Xero and copy Tripcatcher support in on the email.

You need to mention that the problem is with the configuration of your Xero Organisation. Ask them to set up (or re-instate) the Zero Rated Expense. Your standard VAT reports won’t work correctly without the Zero Rated Expenses.

Dext Integration

Q. As a user, how do I connect my Tripcatcher account to my Dext account ?

Creating the connection between Tripcatcher and Dext can be completed in just a few clicks.

- In Tripcatcher, go to the Settings page;

- Select publish to Dext and click the “Connect Dext” button;

- This activates the Tripcatcher connection to Dext;

- Enter your Dext login details;

- Once logged in you will be taken back to the Tripcatcher Settings page;

- Your connection from Tripcatcher to Dext is now setup.

More detailed instructions can be found here.

Q. As a Partner, how do I connect my user's Tripcatcher account to their Dext account?

As it’s very easy for users to connect their own Tripcatcher account to Dext, we have not implemented this functionality on the Partner Dashboard.

However, if this is something you want to do as an Admin user; you will need to know the user’s login credentials to both Tripcatcher and to their Dext account.

You will need to:

- login to their Tripcatcher account

- Go to their Tripcatcher Settings page;

- Select publish to Dext and click the “Connect Dext” button;

- This activates the Tripcatcher connection to Dext;

- Enter their Dext login details;

- Once logged in you will be taken back to the Tripcatcher Settings page;

- Your client’s connection from Tripcatcher to Dext is now setup.

Q. I have a Partner Account, does Tripcatcher automatically publish my users' mileage or do I need to do anything ?

To publish to Dext each Tripcatcher account needs to be connected to Dext. This connection is done by the user.

Once connected each user then publishes their own mileage. This is done from the user’s Tripcatcher Expense Claim page by clicking the “Publish Detailed Claim to Dext”. The user can publish all mileage on the page or can select a date range of mileage to be published.

Q. Can I re-charge a Tripcatcher mileage expense to a client ?

Currently, Tripcatcher does not capture information for re-charging mileage expenses to a client.

However, you may be able to do this in your accounting package; you can do this in Xero Bills.

Q. Does Tripcatcher allow "Tracking" of mileage to a project ?

Currently, Tripcatcher does not capture information for tracking mileage to a project.

However, you may be able to do this in your accounting package, you can do this in Xero Bills.

Q. I have changed company and wish to link my Tripcatcher account to my new Dext account - how do I do this ?

You will need to disconnect your current connection and then re-connect to your new organisation.

- In Tripcatcher, go to the Settings page;

- Ensure the publish to Dext button is selected. Then click the “Disconnect Dext” button to remove the current connection;

- Now click the “Connect Dext” button. This activates the new connection to Dext;

- Enter your Dext login details;

- Once Tripcatcher is authorised to connect to Dext you are taken back to the Tripcatcher Settings page;

- Your connection from Tripcatcher to Dext is now setup.

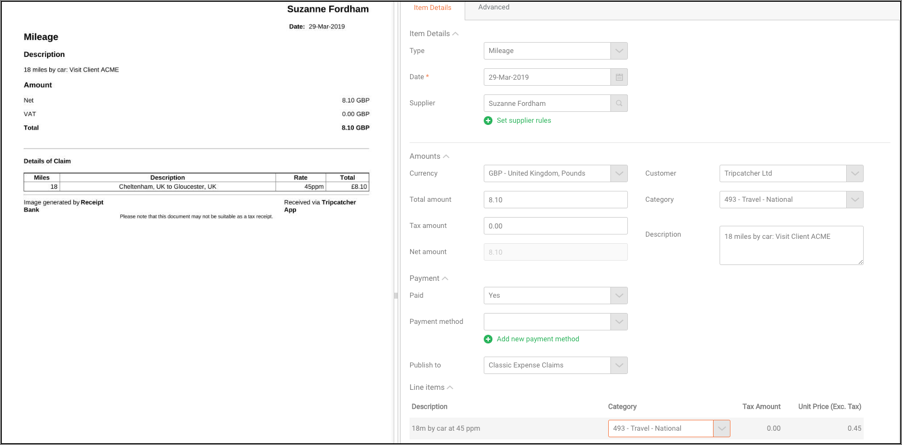

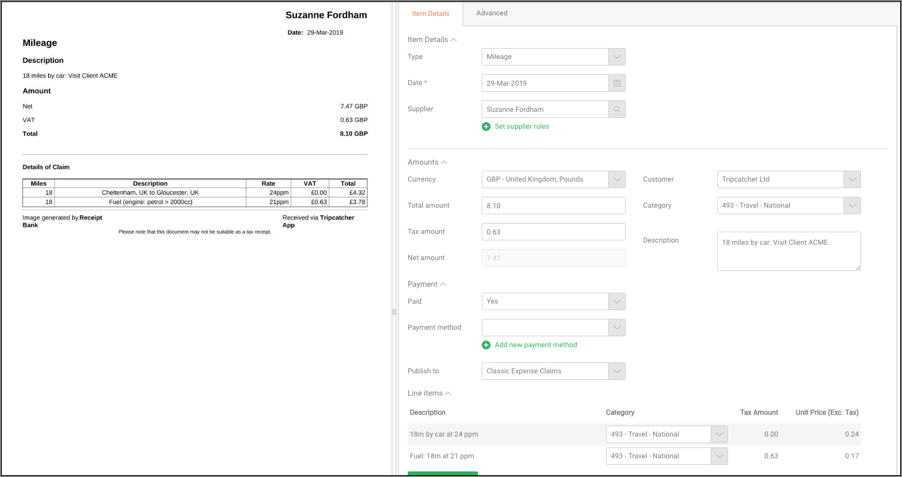

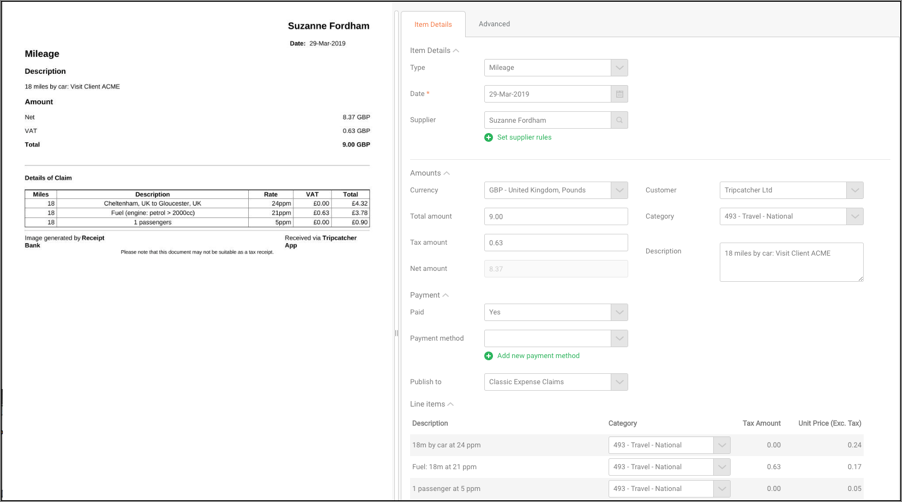

Q. What does a published trip look like in Dext ?

This does depend on what information you are publishing. If publishing a simple trip of 18 miles at 45ppm then it will look like the image below.

If you are reclaiming VAT on your mileage then the trip will appear in 2 line items – one line for the VAT portion and one for the non VAT portion.

If reclaiming for passengers, this information will also appear as a separate line item.

Q. How often should I publish my mileage to Dext ?

We do recommend you publish your mileage to Dext at least monthly. This is especially important if you are claiming VAT on your mileage expenses.

If you business’s financial year is not the same as the personal tax year (6th April to 5th April), we recommend you publish your mileage claim before the end of your business tax year.

Q. I've saved trips in Tripcatcher, both from my phone and PC, but I cannot see them in Dext. Am I missing something ?

Trips saved from the Tripcatcher web or phone app are saved to the Tripcatcher Expense Claim page on the web app and also the phone app. It is from here that they are published to Dext. However Tripcatcher must be connected to your Dext account before you can publish. (See instructions on connecting Tripcatcher to Dext).

To publish your trips from the web app:

- Login to your Tripcatcher web app account;

- Go to the Expense Claim page where you will see all your trips;

- Click the publish button, underneath your summary information, and your trips will be published to Dext;

- Once published all these trips are moved to the Tripcatcher History page where you will see the publish confirmation id from Dext;

- You will also see your Tripcatcher mileage in Dext. Each trip is published as an individual item.

Q. Does my Tripcatcher email address need to be the same as my Dext account email address ?

The email addresses do not need to be the same. But do ensure you login to the Dext Account you want to publish to.

Q. Can I re-publish trips in Tripcatcher that have already been published to Dext in error ?

There is no automatic way of republishing trips to Dext without re-entering them. In Tripcatcher they will have been marked as published and the miles already added to your mileage total.

However, there are a couple of things you can do:

- You can delete these trips from Tripcatcher and re-enter into Tripcatcher and then publish to the correct Dext account. To delete these trips go to the Tripcatcher History page and click on the red dustbin on the right hand side of each trip you wish to delete, then click to confirm the delete. This will adjust the mileage counter total. Then re-enter and publish as normal.

- The other option is to enter a summary journal in your accounting package for the trips you want to re-publish. This mileage information is already in Tripcatcher and will then be in your accounting package in summary form. You could also upload an image/file of the mileage into your accounting package as proof of the individual trips.

Phone App

My phone app is not recording my GPS trips, how do I fix this ?

The first thing to do is to check that you have the correct GPS settings on your phone.

- For iOS users here is the guide on how to check your settings;

- For Android users here is a guide on how to check your settings.

If your settings are correct then please do get in contact with support@tripcatcherapp.com providing as much information as you can about what is happening, together with any screenshots you may have.

How do I get the phone app?

The latest Tripcatcher app is the one with the orange icon and the links for the App Store and Play Store are below:

- For iOS here is the link https://apps.apple.com/gb/app/tripcatcherapp/id1547595380

- For Android here is the link https://play.google.com/store/apps/details?id=com.tripcatcherapp.tc

Can I edit a trip on the phone app ?

At the moment you cannot edit a trip on the phone app. You will need to do this through the web app on your browser.

Trips can only be edited on the Expense Claim page on the web app. Once the trip has been published and is shown on the History page it cannot be edited.

However, if you do not have access to the web app, on the phone app you can delete the trip and re-enter it.

How do I delete a trip on my phone app ?

Instructions below:

- Go to the Expenses tab on your phone app;

- For the year or month of interest, select “show trips in claim”;

- Slide the trip you want to delete to the left, this will show the delete icon;

- Click on this delete icon and you will be asked if you want to delete this expense;

- Click on the “Yes” button and the trip will be deleted from the phone and web app.

If you have any issues or questions regarding this, please get in contact with support@tripcatcherapp.com

How do I delete a favourite trip on the phone app ?

A favourite trip can be deleted from Tripcatcher but only through the phone app (the web favourites are shown on the phone app with a coloured red heart and are synced with the web app). Instructions below:

- Go to the Settings tab on your phone app;

- Select Favourite Trips and this will show your favourite trips;

- Slide the favourite you want to delete to the left, this will show the delete icon;

- Click on this delete icon and you will be asked if you want to delete this favourite;

- Click on the “Yes” button and the favourite will be deleted from the phone and web app.

If you have any issues or questions regarding this, please get in contact with support@tripcatcherapp.com

I have a Huawei phone, will Tripcatcher work on this phone ?

There are 2 issues happening on the Huawei phones:

- Huawei phones can kill apps running in the background in order to prolong battery life. Hence, when Tripcatcher is running in the background for GPS recording, Huawei lets it run for a few minutes and then kills it. This problem is described in more detail here https://dontkillmyapp.com/huawei. The link also describes how to update your phone to stop it killing apps in the background – but it is complex and may require uninstalling PowerGenie.

- The second is that Google Services no longer work on Huawei phones. This is described here https://support.google.com/android/thread/29434011/answering-your-questions-on-huawei-devices-and-google-services?hl=en. Tripcatcher uses Google Services. If your Huawei phone was purchased before 2021 it is worth trying to see if Google Services will still work, if not then its likely Google services will not work and Tripcatcher functionality such as Address Lookup and Distance Calculations may not work.

Crunch Integration

Q. If I have a question about Tripcatcher, how do I get an answer ?

Have a look through these FAQs. If you can’t find the answer to your question, you can contact us or Crunch in a number of ways:

- Send an email to Tripcatcher at support@tripcatcherapp.com;

- Send a message to Tripcatcher from the Contact Page;

Q. How do I 'activate' my Tripcatcher account ?

As a Crunch user you get a Tripcatcher account for free. This is activated through your Crunch account.

For sole traders, start by navigating to ‘Boost your Business’. This is located in the bottom left of your account, simply find Tripcatcher, and select ‘Add Tripcatcher’. You’ll then be taken to Tripcatcher to provide a password and create your account.

For limited companies, start by navigating to ‘Your Account > Subscription’. This is located in the top right of your account. Scroll down to the ‘Mobile Applications’ header and select ‘Activate’ on Tripcatcher. You’ll then be taken to Tripcatcher to provide a password and create your account.

Any issues please do send an email to Tripcatcher at support@tripcatcherapp.com.

Q. How do I cancel my Tripcatcher account ?

In your Crunch account:

For sole traders, navigating to ‘Boost your Business’. This is located in the bottom left of your account, find Tripcatcher, and select the ‘Deactivate’ button. You will no longer have access to your Tripcatcher account.

For limited companies, navigating to ‘Your Account > Subscription’. Scroll down to the ‘Mobile Applications’ header and select ‘Deactivate’ on Tripcatcher. You will no longer have access to your Tripcatcher account.

Q. Do I have to pay for my Tripcatcher account ?

For sole traders and limited companies Tripcatcher is free 🙂

Q. I have saved a trip on my Tripcatcher phone app where will this be saved to ?

Once a trip has been saved on your phone app, it will be published directly to your Crunch Expenses.

Q. Can I edit a trip once I have saved it in Tripcatcher ?

When you save a trip from the Tripcatcher web app it will automatically be published to Expenses in your Crunch account.

The trip will also be saved in Tripcatcher on the History page. You can edit the trip in your Crunch account as normal.

Q. Can I claim for passengers ?

You can claim 5 pence per mile per passenger providing your passengers are employed in the same company as you.

You can only claim for passengers if you were driving a car or a van.

Q. Can I reclaim the VAT on my fuel in Tripcatcher ?

Yes you can, this is a new feature in Crunch and you do need to contact Crunch support about this. Please send an email to Crunch at support@crunch.co.uk.

Q. How do I reset my password ?

On the Login form, there is link for you to click to reset your password.

Click this link and a new form will be displayed for you to enter your Tripcatcher email address.

An email will be sent to you at your Tripcatcher email address with a link in it. Click the link and you will be taken to a screen to enter your new password. If the link does not work, copy and paste it into the browser.

The email should arrive within a few minutes. If you do not receive the email check your junk and spam folders for a message from tripcatcherapp.com. If you do not find the email in your spam or junk folder then send an email to support@tripcatcherapp.com requesting a re-send.

Q. Can I delete or rename the Supplier "Tripcatcher" ?

It is recommended that you do not delete or re-name the Supplier “Tripcatcher”.

If you delete the Supplier “Tripcatcher” you will not be able to save trips from Tripcatcher to Crunch.

Q. I have deleted the Supplier "Tripcatcher" from my crunch account. How can I fix this?

If you delete the Supplier “Tripcatcher” and try to save a trip you will get the error message “Trip Not Saved: Error:http 400”. To fix this you need to:

- Go into Crunch Connect and de-activate your Tripcatcher account;

- Now activate Tripcatcher again. This will create a new Tripcatcher Supplier. Do not delete it or rename it;

- Delete the Tripcatcher phone app, re-install it and login again;

- Tripcatcher should now work.

Q. How do I delete a saved trip ?

A saved trip will need to be deleted from Tripcatcher and also from Crunch. The instructions below are how to delete from Tripcatcher, you will also need to delete the same trip in Crunch otherwise the two systems will be out of sync.

- Login to Tripcatcher through a browser (not the phone app);

- Go to the History page and locate the trip;

- Click on the dustbin on the right hand side of the trip information;

- This will bring up the delete confirmation box, click the “Delete” button and the trip will be deleted in Tripcatcher;

- The Tripcatcher mileage counter (on the Tripcatcher Settings page) will also be updated with the new mileage, as will the History page summary.